How can businesses with global operations use international investment agreements to manage their political, economic and country risks?

All businesses with international operations are exposed to political, economic and country risks on a daily basis. This is more prevalent than ever owing to currently heightened activity in a large number of politically unstable nation states, such as those in the Middle East, Africa and parts of the former Soviet Union.

Examples of the risks faced include political and civil unrest, discriminatory treatment (with local businesses being treated more favourably than foreign investors) and the imposition of new unfavourable regulations such as harsher tax regimes etc. Businesses may, as a result, experience significant economic slowdown, supply chains being squeezed, a shut down of operations (whether temporary or permanent), damage to business premises and assets, loss of staff and so on.

Although such risks in cross-border investments are unavoidable, some strategies protect and provide avenues of relief against these risks. One such measure of protection, considered here, is the use of international investment agreements (or IIAs).

Types of IIAs available to a foreign investor

IIAs are agreements entered into between states for the express purpose of protecting and promoting foreign investments. Importantly, they set out broad, substantive protections for investments and allow an investor of one country to seek money damages and other relief directly against a government of another country for breaches of those protections in a neutral international arbitration forum. They provide a state with a strong incentive to treat foreign investments fairly.

A network of about 3,000 such IIAs covers many territories worldwide.

They include bilateral investment treaties or “BITs” (between two states), multilateral investment treaties (between several states), regional agreements (between states in the same geographical region) and investment protection provisions contained in free trade agreements between two or more states.

Some examples of key multilateral investment treaties include:

- the ASEAN Comprehensive Investment Agreement (ACIA), which came into effect in 2012 between Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam;

- the North American Free Trade Agreement (NAFTA), which came into effect in 1994 between Canada, Mexico and the US;

- the Energy Charter Treaty(ECT), which entered into force in 1998, with 54 signatories and covering economic activity in the energy sector;

- the Dominican Republic–Central America Free Trade Agreement (CAFTA-DR), which entered into force in 2006 between the US, Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua and the Dominican Republic;

- the Comprehensive Trade and Economic Agreement (CETA) between the EU and Canada. Negotiations have been finalised over this agreement but it is not yet in force;

- the EU is currently negotiating a trade and investment deal with the US: the Transatlantic Trade and Investment Partnership or TTIP; and

- at the 16th EU-China Summit on 21 November 2013, both sides announced the launch of negotiations of a comprehensive EU-China Investment Agreement.

How IIAs work and protection they afford investors

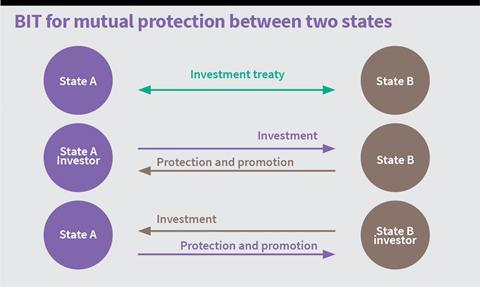

Below is a simplified diagram in which states A and B conclude a BIT for the mutual promotion and protection of investments by investors of these states in the territory of the other state party to the treaty.

If an investor from state A makes an investment in state B, that investment then enjoys protection under the BIT and that investor acquires direct rights against state B. The same is true for an investor from state B making an investment in state A.

What is important about these IIAs is that they exist independently and in addition to any contractual rights, or in other words, a direct contract with a government is not necessary to gain protection. They can also enhance existing contractual obligations (such as through the umbrella clause, described below).

IIAs differ in their scope, wording and structure. The protections that are generally available include: fair and equitable treatment (FET); full protection and security; national treatment; most favoured nation (MFN) treatment; protection from expropriation; freedom of transfers; and an ‘umbrella clause’ whereby states undertake to observe obligations entered into in respect of investments.

The nature of each of these protections is outlined below, although often the determination of the scope of the protections is complex and fact-specific.

Fair and equitable treatment (FET)

This is the broadest of all protection standards, which may be potentially applied to a variety of situations. It includes: protection of legitimate expectations of investors; prohibition of discriminatory or arbitrary treatment; obligations of consistency and transparency; and protections against bad faith, coercion and harassment. It also includes protection against an insufficient level of administration of justice in the local courts of the host state (known as denial of justice).

The importance of the FET standard for the investor lies in its versatility. It is an appropriate standard to invoke against, for example, inconsistent decisions of the local authorities, arbitrary judgments, empty promises of high-level politicians regarding key aspects of an investment, orchestrated actions of local authorities targeted at an investment, as well as measures driven by political, nationalistic or protectionist considerations, which affect the operations of an investment.

Full protection and security

The full protection and security standard protects the investor, its officers, employees and assets from acts of physical violence of the host state and its agents. It also renders the host state internationally liable in case of violence coming from third parties, whenever the state has failed to act with due diligence to prevent or stop the attack, or prosecute the offenders. It has been invoked, for example, where Zairian soldiers destroyed an investor’s property during riots.

Some tribunals have accepted that nowadays the obligation extends beyond mere physical protection and also includes components of legal security of an investor in the host state, such as access to legal remedies.

National treatment

This, and the MFN standard below, is intended to provide investors with a level playing-field. This requires states not to discriminate between foreign investors and its own nationals. As an example, this standard was breached in one case where domestic exporting companies were entitled to VAT refunds that foreign investors were not.

Most favoured nation (or MFN) treatment

This requires states not to discriminate between the investments of different foreign nationalities. On the most basic level, it would apply for example if state A passed legislation entitling investors from state B to apply for natural resource concessions in state A, but denying the same right to investors from state C.

(MFN treatment also allows foreign investors that benefit from BIT protection to take advantage of more favourable provisions in other BITs entered into by their host state. So, if the BIT between states A and B does not include an FET (or has only a narrow FET) provision but contains an MFN provision, and there is another BIT between states A and C that does have a broad FET clause, investors from state B can argue that they are entitled to the FET treatment by state A by virtue of the MFN provision contained in the BIT between states A and C.)

Protection from expropriation

Most BITs provide that states must not expropriate – or take a measure equivalent to expropriation of – an investment except where such an act is: (i) for a public purpose; (ii) on a non-discriminatory basis; (iii) carried out in accordance with due process; and (iv) is accompanied by appropriate compensation.

Such a provision covers both “direct” and “indirect” expropriation. The term “direct expropriation” includes the classic forms of expropriation such as the nationalisation of an entire industry; the taking of property during wartime or national emergency; or compulsory acquisitions of property by a state without compensation.

The term “indirect expropriation” covers measures that are not outright acquisitions but that in effect amount or are equivalent to expropriation. In these cases, an investor retains the legal title to its investment, but in effect loses its enjoyment of the investment as a result of the sovereign measures imposed by the state. An example is a failure to renew an environmental permit by the state without which the investor cannot operate.

Transfers

Even the most profitable foreign investment would be of limited use for the investor if transfer of revenues is subject to extensive restrictions. Most IIAs include guarantees that such transfers shall be made in a freely convertible currency, without undue restriction and delay.

Umbrellaclause

This provision requires the host state to comply with its undertakings regarding investments. It may be relevant, for example, where a state has entered into a stabilisation clause in an investment agreement (a clause freezing applicable regulations and/or legislation in the host state affecting the business to those in effect as at the date the investment agreement was entered into).

How to structure an investment to take advantage of IIA coverage

IIAs set out expressly which investors and investments they cover. Typically, they cover all companies and persons that are nationals of one of the states that has signed the relevant IIA. The nationality of a person is usually determined by the individual’s citizenship and/or residence; the nationality of a company is generally determined by either the company’s country of incorporation or primary place of business, although some IIAs require a company to demonstrate that it has economic activity in the country of its alleged nationality.

Most IIAs also define investment broadly using wording such as “every kind of asset” and in effect covering almost anything with monetary value. Thus, IIAs may cover, among other things, titles to money, shares, stocks or other interests in a company, investments in sovereign wealth funds and private equity funds; supply contracts or concession contracts with the government, rights to intellectual property and goodwill.

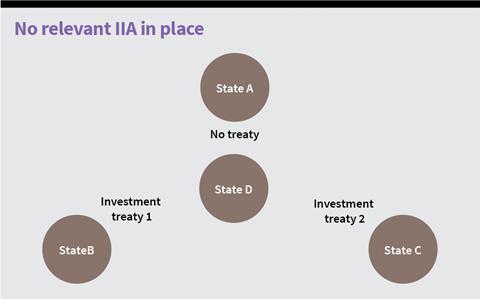

If an investor or investment does not already fall within the scope of an existing IIA, it is often possible to restructure a business to gain protection. So, a situation may arise where a company from state A wants to develop a project in state D, but there is no treaty between states A and D. State D does, however, have treaties with states B and C.

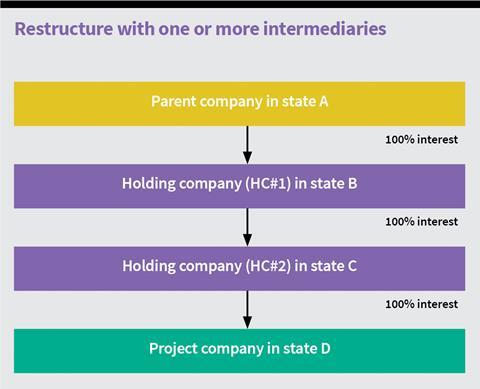

One could restructure and set up a structure like the one below, with one or more intermediary holding companies incorporated in states B and C.

If a dispute arises, holding company (HC) #1 and HC#2 from states B and C will be able to claim as investors with respect to the project in state D. Each will have a separate claim; they may claim in parallel, or the group may choose the more favourable investment treaty. How best to structure will depend on the choice of available treaties, and of course other implications such as tax planning.

Examples of successful structuring are: involving a subsidiary (because the parent is not eligible for protection); inserting a (say, Dutch) holding company to gain standing for the local investment vehicle; or investing through a tax-efficient jurisdiction that has a BIT with the host country. Arbitral tribunals have expressly recognised that such structuring works “The language of the definition of national in many BITs evidences that such national routing of investment is in keeping with the purposes of the instruments and the motivations of the state parties”: see Aguas del Tunari SA v Bolivia, 21 October 2005.

Importantly, the restructuring must be carried out before the dispute with the host state arises; restructuring an investment only in order to gain IIA protection constitutes an “abuse of treaty” and in such circumstances protection is likely to be denied.

Modes of dispute resolution and organisations designated to hear them

Most IIAs provide investors with direct access to international arbitration. This guarantees investors recourse to a neutral forum, independent from the local courts of the host state. Moreover, it ensures that where a state breaches its obligations under the IIA, the state’s conduct is assessed against international law standards.

Most IIAs provide the investor with a choice of dispute resolution mechanisms. The choice usually includes one or more types of arbitration (and possibly also litigation before the local courts).

The type of arbitration most commonly referred to in IIAs is ICSID (The International Centre for Settlement of Investment Disputes) arbitration. ICSID was set up by the Convention on the Settlement of Investment Disputes between States and Nationals of Other States, which was entered into force on 14 October 1966 under the auspices of the World Bank. ICSID handles the vast majority of investment treaty cases. ICSID arbitration will be available only where both state parties to the IIA are signatories of the ICSID Convention. (Where only one state is a signatory, the ICSID Additional Facility Rules may be available as an option, if provided for in the IIA.)

An advantage of ICSID arbitration over domestic court proceedings is that a contracting state is prevented from invoking sovereign immunity from suit.

Although the ICSID Convention leaves the law on state immunity from execution of an award intact, a contracting state that invokes immunity from execution to frustrate the enforcement of an ICSID award would be in violation of its duty to comply with that award. It should be stressed at this point that historic rates of compliance with ICSID awards are encouraging from the private investor’s perspective. To date, member states have, with few exceptions, co-operated fully in the arbitration process and judgments have been paid. ICSID arbitral awards are moreover equivalent to a final judgment of a court in member states, and accordingly are directly executable. Out of all the cases registered, only four appear to have been challenged at the enforcement stage.

Two other forms of “institutional” arbitration often offered are ICC (International Chamber of Commerce) arbitration and SCC (Stockholm Chamber of Commerce) arbitration.

Some IIAs may require the investor to first exhaust local remedies, in other words to take their dispute to the local courts, and only if unsuccessful before the local courts allow the investor to resort to arbitration or to embark on a ‘cooling off’ period attempting to settle the dispute amicably before initiating arbitration.

Points a state may try to challenge

It is typical for states to raise certain objections to the jurisdiction of the arbitral tribunal that is constituted. Sometimes, this is a strategy to delay proceedings. A state might employ various arguments, for example, that:

- the company is not a “real investor” and does not conduct substantial business activities in the territory of the host state;

- the investment is not made in accordance with the local laws of the host states or is tainted by some irregularity such as bribery or the submission of fraudulent documents; or

- there has been a failure to comply with the exhaustion of local remedies or cooling-off period requirements.

Where the dispute concerns a BIT between two EU states, the state party may make arguments to the effect that obligations in the IIAs are inconsistent with EU law. For example, in relation to one recent case in which two brothers (the Micula brothers) were awarded compensation against Romania in an ICSID arbitration, the European Commission concluded that the compensation was paid in breach of EU state aid rules and should be repaid. Enforcement of the award is currently being sought by the brothers in the US courts.

Investor state arbitration has recently come under public attack, as part of the discussions surrounding the TTIP. Those criticising the system cite concern that arbitration proceedings undermine democratic structures and there is potential for rulings to obstruct a government’s rights to regulate. This is a debate for another article and should not detract from the key message: IIA protections exist and businesses should consider how to avail themselves of those protections when investing abroad. This may be in conjunction with consideration of other mechanisms that may be more familiar to the reader, such as political risk insurance.

Examples of famous recent disputes

The United Nations Conference On Trade And Development update on IIAs dated April 2014 reports that, in 2013, the overall number of concluded investor-state cases pursuant to IIAs reached 274. In 2013 alone, investors initiated at least 57 such cases. Investors challenged a broad range of government measures, including changes related to investment incentive schemes, alleged breaches of contracts, alleged direct or indirect expropriation, revocation of licenses or permits, regulation of energy tariffs, allegedly wrongful criminal prosecution, land-zoning decisions, invalidation of patents and others.

Three examples of famous recent disputes:

- Argentina: In October 2013, it was reported that Argentina had agreed a settlement relating to five investment treaty arbitration awards made between 2005 and 2008 for more than $450m (€395m) plus interest. Although each case concerned a different set of facts, all the claims arose out of Argentina’s financial crisis and the privatisation of various industries. The cases concerned forced tariff reductions relating to water and sewage concessions and gas transport services; a devaluation of an investment in the electricity sector; and losses resulting from the devaluation of the peso and related measures taken by Argentina.

- Russia: On 18 July 2014, former shareholders in Yukos were awarded $50bn in a dispute against the Russian Federation under the ECT for the expropriation of Yukos. This is the largest damages award to date in an investor-state arbitration. In 2002, Yukos was Russia’s largest oil and gas company. The claim was that Russia took a series of measures (including the imposition of taxes) leading to Yukos being declared bankrupt in August 2006 and Russian state-owned companies Gazprom and Rosneft acquiring Yukos’ assets at a discount.

- Libya: In the aftermath of Arab Spring, foreign investors initiated a string of claims against states in the MENA region. In March 2013, the Kuwaiti Conglomerate, Al Kharafi & Sons, was awarded $935m in a dispute against Libya for its obstruction of the construction and operation of a tourism complex. This was the second largest known award.

Ania Farren is a special counsel, specialising in international arbitration, at K&L Gates LLP

Downloads

PDF of article

PDF, Size 0.66 mb

No comments yet