Energy investments are long-term, highly capital-intensive programmes. One simply cannot click a switch and expect to solve the problems of today

Much is being said and written about energy and the rampant price increases in gas and electricity prices. Since late 2021 the cost of energy has been in the headlines as we witnessed the collapse of several UK energy supply businesses.

As we entered 2022, the war in Ukraine has further exposed and highlighted the vulnerability of our energy sources and logistics with renewed scrutiny on Europe’s main source of gas, Russia.

The ability to access cost efficient and reliable sources of energy to meet our energy needs and ensure greater certainty in terms of availability and price for both households and businesses has never been more uncertain.

Overcoming current and future energy challenges requires the industry to cast a critical eye on the risks facing us all not only now, and well into the future.

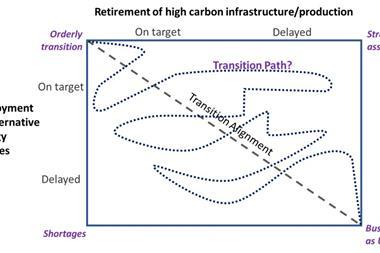

Combined with the manifest challenges of decarbonisation and the drive toward net zero, risk management plays a critical role in helping to drive the decisions and the strategies needed to ensure our energy security.

Volatile risk landscape

We look at the current situation through a risk management lens to understand the how and why of the current situation. We also investigate how taking a risk-based approach to the energy sector strengthens planning and strategy, and delivers stronger, more resilient outcomes.

It is rarely disputed that there could not have been a worse time for a gas supply crunch than in the wake of the recovery from the global Covid-19 pandemic.

With the world emerging from an extended period of uncertainty and unprecedented disruption, supply chains were already strained, and inflation was approaching record levels not seen for decades in most developed economies.

And now we are seeing projected winter 2023 power prices for France, Germany and the UK at all-time highs, indicating that the worst is yet to come.

With recent record temperatures across Europe exerting additional stress on electricity demand, there is doubt as to how the UK and Europe will be able to fulfil basic energy needs to fuel industry and heat homes come this winter.

Weaknesses in strategic and emergency planning

There is a lack of foresight and understanding of the risks facing energy supply, and this appears to have been the case for some time.

While it can be argued that centralised planning of energy markets is, to a certain extent, necessary, there are lingering doubts as to the efficacy of the methods and approaches used to assess and understand the relevant risks that should be used to inform strategic planning exercises.

Where has OFGEM and the relevant government department(s) been on this?

Looking at electricity, the approach of firing-up existing coal plants is one option. Despite environmental arguments against such a response, somewhat warranted; such action may offer some respite and a relative quick fix.

However, from an economic point of view there is nothing convenient nor desirable about re-commissioning old inefficient coal plants. The costs associated with bringing these assets online need to be covered, and someone has to pay the asset owners. The costs of re-commissioning plants (or remaining on standby) in itself further exacerbates prices and inflationary risks.

Changing consumer behaviours?

Recent moves by the UK government to encourage households to reduce peak time electricity consumption as a way of reducing their bills (and trying to dampen demand) may look like a step in the right direction, but is it a sustainable approach to managing the risk, and does it deliver what the consumer needs?

Asking consumers to simply “use less” is not a way forward, and nor is it sustainable. Additionally, with a potential recession facing Europe and the UK, it will only increase pressures over the near term.

It hardly seems fair to place the consequences of poor central planning onto the consumer. It takes time to adjust and adapt.

And to what extent have the vast number of knock-on impacts, including jobs and further supply chain disruption (at a time of global recovery) to name just two, been factored in?

The unintended consequences of load shedding and arbitrary demand side management have the potential to further fuel inflation and impact levels of unemployment.

When we consider risk management and resilience we are looking at how to maintain an acceptable level of supply and/or service to meet the needs of stakeholders.

It’s a classic case of missing objectives and shifting the goal posts to such an extent the entire exercise in supplying energy becomes futile.

Is net zero a panacea?

In what some have described as a failure of effective centralised planning, there has been a rush away from existing solutions such as Nuclear to service essential baseline demand towards what now appears to be a rushed embrace of intermittent unreliable renewables as the main source of an electrified future.

Net zero was sold as the panacea to the environmental challenges faced by our societies, but it must be asked whether we are moving too quickly without paying due regard to energy security, the bedrock on which our civilisation is built

The current thinking has been to blindly accept a narrow range of renewable technologies as the default strategy for a carbon-free electrified future.

This has limited our ability to respond to the current risks we are witnessing in energy markets right now, as we no longer have a wide enough range of options from which to choose from when responding to events.

Switching to LNG, as many are currently doing, requires time and adequate LNG capacity as they are now discovering.

What is achievable right now?

Setting strategy, objectives, targets and more importantly, government policy, should always be rooted in reality and be well thought through by both legislators and bureaucrats.

The challenging questions they should be asking of themselves are:

- What is realistically achievable?

- Is it sustainable?

- Will we be resilient the face of systemic shocks?

- Can we (as a nation / economy) afford it, given the relative benefits?

- Does our current market structure support what we need to do?

- If we are changing, have fully considered the implications of making these changes?

- Have we fully and objectively engaged with stakeholders to understand our current capabilities, and gaps?

- Have we considered all options available to us?

In attempting to mitigate against the risk of failing to deliver secure and affordable energy it may be that (in this case) the generation mix needs to be adjusted by continuing the use of cheap, reliable fossil fuel as one of the main sources, while executing on a strategy of net zero.

Other factors

Weather is the single most important factor impacting demand for electricity and gas.

Climate change and factoring anticipated changes into our forward planning and scenarios needs to form part of critical systems planning to provide a wider range of potential outcomes, and with that, development of effective responses.

Responses should consider climate adaptation strategies alongside efforts to reduce carbon emissions, and limited funds should be diverted to the options that offer the best cost to benefit ratios.

There are also a lot of other risks to be considered, notably cross-sector risks and impacts fall-out, and the systemic risks (payment defaults for example and how this has a knock-on effect which could be, for energy supply companies, not unlike the financial crisis was for financial institutions).

Co-ordinating across a wider range of government departments and agencies, and stakeholders, also needs to be beefed up.

It’s not too late to learn from the past

Ignoring risk does not make it go away (others say ’Hope is not a strategy’, and they would also be right in this case).

Why wasn’t this looked at years ago and why has such a scenario not been factored into the British Energy Security Strategy (April 2022) or a National Resilience Plan?

To understand where we’re at and how we got here we need to go back and think about what we’ve seen before. In this current debate and looming crisis, one key area which has been lacking is that of energy market regulation.

Why was the likelihood of a Russian invasion into the Ukraine not more closely monitored and acted on much earlier? The warning signs have been there for all to see since the 2014 invasion and annexation of Crimea.

Germany especially should be seen as a lesson in what not to do on geopolitics, and with it, energy security and sustainability.

Time to get real

If nothing else, we have learnt that energy investments are long-term, highly capital-intensive programmes, one simply cannot click a switch and expect to solve the problems of today.

What this current situation has highlighted for many is lack of joined-up thinking when it comes to the strategies, initiatives, policies, planning and geopolitics.

Failures in constructively challenging embedded thinking, a willingness to accept optimist timelines for environmental targets and a gaping lack of accountability when it comes to planning and understanding risk, opportunities, and reward, have all combined to create a crisis which, ordinarily, could and should have been avoided.

Moving beyond the immediate issue, one needs to start delving into the wider impacts of energy strategy and consider how to build-in resilience.

For example, future-proofing critical industries and sectors requires incentives for companies to invest in developing the talent and capacity needed to not only bring the necessary infrastructure to market on time and on budget, but also to develop a sustainable pool of world-class, highly-experienced resources.

This will ultimately reduce our dependency on external sources and countries (which leaves us subject to uncontrollable supply chain, geopolitical, legal, regulatory and pandemic-type risks, to name a few).

Written by Grant Griffiths, Dylan Campbell, and Alexander Larsen, CFIRM, on behalf of the Institute of Risk Management (IRM) Energy Special Interest Group

Putin exposed as Ukrainian forces recapture more territory

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

Currently reading

Currently readingWhy we should have seen the energy crisis coming

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

No comments yet