No one can control the wind and the wrong kind of weather can place revenue streams under real pressure. But here’s the solution…

Renewable power is here to stay. Global investment is expected to top $2trn by 2030 and 75% – or 900gigwatts – will be in solar and wind sectors, both onshore and offshore.

But while the opportunities are lucrative, one of the biggest threats to the sector is weather-related risk. After all, no one can control the wind and the sun – and the wrong kind of weather can place revenue streams under real pressure.

So, what happens to businesses who rely heavily on the wind or solar power when the wind doesn’t blow, or blows too hard, or the sun doesn’t shine for long enough?

The reason this is particularly relevant now is that governments are getting out of the business of providing subsidies

The answer is they suffer – unless they plan ahead.

In terms of business continuity, wind and solar ‘farmers’ are, like more traditional farmers, at the mercy of the elements.

They can choose to cross their fingers and hope that, over time, the good years balance out the bad. Or they can take a more proactive approach and turn to the insurance sector to help them hedge.

Hedging the risk

“The reason this is particularly relevant now is that governments are getting out of the business of providing subsidies,” says Stuart Brown, head origination weather and energy at Swiss Re Corporate Solutions. “With a subsidy, you didn’t have to worry about the wind not turning up because you were getting a generous enough rate.”

But now this has changed. And risk managers can look to their insurers for support.

“We write products that hedge this risk,” says Brown. “I believe that most risk managers are not sufficiently aware of this because they haven’t had to hedge their wind resource in the past, and so they haven’t got used to doing it. But we are here to help.”

He adds: “It’s also important to remember that insurance is there to cover more catastrophic losses, such as when the wind blows too hard and storms hit your facility – even when it comes to covering new technology and providing bespoke solutions.”

Innovative solutions: the High Wind 2 case study

Equinor, previously StatOil, has made major investments in renewable energy with its High Wind 2 project .This 30 MW wind turbine farm is built on floating structures at Buchan Deep, 25km off shore Peterhead to the east of Scotland.

The technology being used was radical. “Normally, offshore wind farms are fixed to the floor, but the company’s platform floats, which on the face of it, looks quite top heavy, and seemed quite a challenge from an insurance point of view,” says Brown.

“There were questions of how it would behave in a storm, and lots of unknowns. And because no-one had really done this on a commercial scale before, the only real guide was the prototype, which was a much smaller machine.”

It was a matter of talking to Equinor, getting close to the project staff to understand the risk, and crafting a ‘sleep easy’ construction insurance solution with a wide coverage

Swiss Re Corporate Solutions was determined to find a solution and so looked hard at what was in front of them. Yes, it did look highly prototypical. But they had a pilot which had been running for several years.

In addition, they were dealing with a very big, successful oil company, with many years of experience on major projects. Plus, there were technical synergies with what they were doing in oil and gas.

The sleep easy solution

“For us, it was a matter of talking to Equinor, getting close to the project staff to understand the risk, and crafting a ‘sleep easy’ construction insurance solution with a wide coverage,” says Brown.

“We stopped looking at the technology as a prototype and thought about it instead as something that was more proven, and so were able to offer insurance at a reasonable price.”

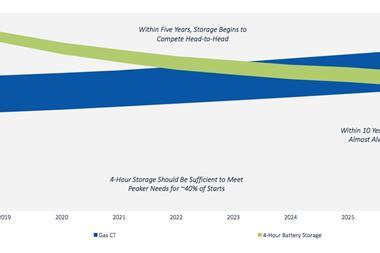

In addition, as technology improves, battery storage will become more and more significant as a way of managing a lack of wind.

We stopped looking at the technology as a prototype and thought about it instead as something that was more proven, and so were able to offer insurance at a reasonable price

“Battery storage allows projects to hold energy when demand is low and export when this increases,” says Jonny Martin, associate, renewable energy practice, JLT Specialty.

“Being able to hold excess energy mitigates against the benefits of traditional energy supplies and this is a rapidly evolving area across all renewable energy technologies.”

In short, with the right preparation, it might not matter for much longer which way the wind blows.

No comments yet