The three pronged crisis deal poses a major challenge for European banks who may slice their lending to meet new capital requirements

At a meeting in Brussels eurozone leaders agreed an emergency deal to stem the worsening sovereign debt crisis.

Europe’s heads of state agreed to increase the size of the European bailout fund to €1 trillion.

They also decided to order banks holding Greek debt to accept a 50% loss.

European banks were also asked to raise €106bn of fresh capital by June 2012 to protect them against future government defaults.

The framework for the new, increased fund should be in place in November.

These decisions will pose a “major challenge” for European banks, said PricewaterhouseCoopers. There is a danger that some banks attempt to meet it by slicing lending instead of raising capital.

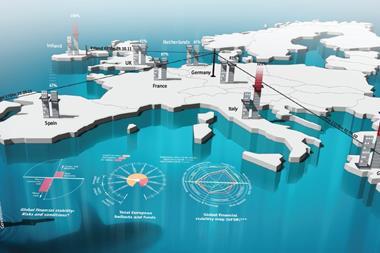

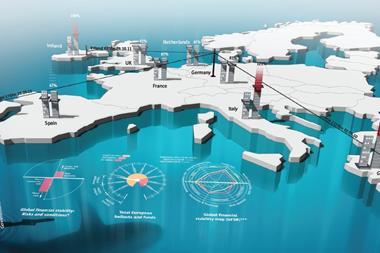

According to the European Banking Authority of the €106bn shortfall, €79bn is attributable to the eurozone’s “peripheral” economies, with Greece (€30bn) and Spain (€26.2bn) topping the list, followed by Italy (€14.7bn), France (€8.8bn), Portugal (€7.8bn) and Germany (€5.2bn).

“In effect the European financial problems in 2011 have driven governments to bring forward the higher capital requirements that Basel III wanted. Basel mandated a tightening of requirements over an extended period of ten years, at least partly, to avoid a resulting contraction of credit with its adverse economic effects. The EU has front loaded it,” commented Patrick Fell, a partner at PwC.

“To meet the mid 2012 challenges banks will need to manage their capital programmes carefully,” added Fell. “They might find they adopt a quick fix now, but implement a more cost effective strategy when the market has got over the bulge in the next few months.”

The full effect on individual institutions is not yet clear, said Fell. “We will have to wait to see the market’s reaction before understanding the implications for other eurozone countries.”

German Chancellor Angela Merkel said in Brussels that the decisions would be “leading the problems one step closer to a solution”.

The European deal

- Banks holding Greek debt to accept a 50% loss

- A boost to the eurozone’s main bailout fund equal to €1 trillion

- Banks must also raise more capital to protect them against losses resulting from any future government defaults

No comments yet