New product designed to stabilise insurance portfolios, but it’s not available to financial firms

Aon and Allianz have launched a new product aimed at restoring confidence in insurance portfolio stability.

Aon has partnered with Allianz Global Corporate and Specialty to develop Double A Protect, an insurance solution that provides multi-line excess capacity of up to €25M from a Standard & Poor’s AA-rated insurer.

The solution covers General Liability and Directors & Officers, including up to five years of retroactive cover for GL.

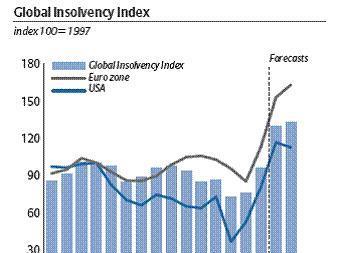

Double A Protect was designed to stabilise insurance portfolios during market volatility by protecting against insolvency. The product affords a drop-down option for companies with concerns about the performance of their portfolios.

Coverage is offered on a claims-made basis and available to non US-headquartered companies in all industries, with the exception of financial institutions.

Marguerite Soeteman-Reijnen, Aon chief broking officer for EMEA, commented: ‘Our clients expect distinctive value from us and that means developing solutions that match their needs and requirements in today’s changing market place. Following the turmoil in the financial services sector, we know what we know today, however we don’t yet know what tomorrow will bring.’

Andreas Berger, global head of market management and communication at Allianz Global CS, added: ‘Clients needed a response that was quick but appropriate for dealing with the market’s volatility. Our close risk dialogue enabled us to create a truly innovative solution that provides stability in a time of uncertainty.’