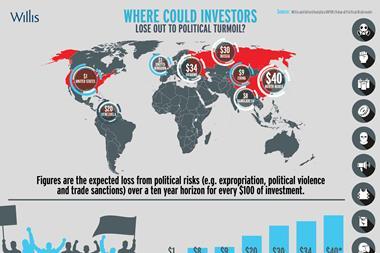

As people around the world cast their votes in a variety of important polls this year, businesses must prepare for considerable change in the geopolitical risk landscape

The World Economic Forum’s Global Risk 2014 report cites political and social instability among its top 10 global risks.

This particular threat is likely to become an even more severe concern in the next few months, as several key elections take place in countries around the world. The results of any of these elections could have a significant effect on businesses, and companies must therefore brace themselves for a period of potential political uncertainty or policy changes.

Throughout April and early May, India went to the polls in what was the biggest election ever held. By the end of the process, some 814 million people voted – with 20% doing so for the first time. The well-established Congress party has been in power for 54 of the 67 years since India gained independence, but its popularity has diminished as a result of economic and well-publicised corruption issues.

With the votes still being counted as StrategicRISK went to press, a genuine possibility remained that India could be headed into uncharted political territory.

On 25 May, another significant election is due to take place in Ukraine for the country’s presidency.

Russian interference in Ukraine, following the Supreme Council’s decision to dismiss president Viktor Yanukovych in February and Crimea voting to join Russia, has led the EU and the US to impose economic sanctions on Moscow, with further action likely if the parties cannot resolve their differences.

Whatever the outcome, controversy is almost guaranteed and companies in surrounding regions must prepare for possible changes to trading regulations according to Azzizza Larsen, head of Willis’s financial specialist unit for the Nordic regions.

“If there is continued uncertainty and the EU imposes wider economic sanctions, it will affect Nordic companies because Russia is one of the two largest emerging market trading partners together with China for the Nordic countries, particularly in Finland and Sweden,” Larsen says.

By the end of the year, elections will also have taken place in South Africa, Indonesia and Egypt, a country that has experienced a deadly transition since president Hosni Mubarak was overthrown in 2011 after almost 30 years in power.

On a wider political scale, the European Parliamentary elections are taking place between 22 and 25 May.

Under the Lisbon Treaty of 2009, Parliament’s role in electing the Commission President has become more prominent. The European Council, composed of the EU’s heads of state and government, must now base its proposal for a candidate to succeed José Manuel Barroso as Commission President on the results of the European Parliament elections. Members of the European Parliament (MEPs) will then vote on the proposed candidate. The candidate must be approved by a majority of MEPs (at least 376 voting in favour out of the 751 members that compose the Parliament) to be elected.

What the composition of the new Parliament will be is as yet unclear, but many political analysts believe that right-wing and nationalist political parties across the continent are set to make strong gains amid voter frustration at continued economic problems and anger over perceived immigration issues.

The Swedish general election takes place in September, four days before a referendum that could see Scotland separate from the UK if a majority respond affirmatively to the question of “Should Scotland be an independent country?” The result could have a significant effect on businesses operating from and within Scotland.

Banking giants Lloyds, Royal Bank of Scotland (RBS) and Standard Life have expressed concerns over the economic and operational challenges they will face if Scotland votes for independence, with RBS and Standard Life making their contingency plans public.

Also in the public eye is Brazil, where presidential elections will take place at the beginning of October. The election build-up has seen political and societal unrest spill onto the streets in protest over the economic disparity that divides the nation and the billions of dollars spent on staging next month’s football World Cup.

A slowdown of economic growth in Brazil means that the next government will be tasked with stimulating growth and trying to lift the country back to its position as a powerful emerging economy. However, strong protests urging investment into healthcare services and public transport will give the authorities a challenge to balance its fiscal responsibilities.

The past five years have been increasingly difficult for companies to manage political risk, according to Larsen, but this year’s elections are likely to alter the future corporate environment for better or for worse.

“The World Economic Forum’s Global Risk Report 2014 listed profound political and social instabilities, as we are seeing in Brazil, and fiscal crises in key economies as two of the top 10 risks in 2014 and this is the case for companies all over the world,” Larsen says. Asa Gibson

1: 7 May South Africa general election

2: 16 May India general election results

3: 22-25 May European Parliament

4: 25 May Ukraine presidential election

5: 26 May Egypt presidential election

6: 9 July Indonesia general election

7: 20 July Thailand general election

8: 14 September Sweden general election

9: 18 September Scottish referendum on independence

10: 5 October Brazil general election

No comments yet