Risk managers face reduced political violence (PV) insurance and strikes, riots and civil commotion (SRCC) cover, thanks to global outbreaks of violence

2023 spells trouble for risk managers as they have to contend with significantly reduced risk appetite in the political violence (PV) and strikes, riots and civil commotion (SRCC) insurance markets, caused by an increasingly unpredictable threat landscape.

What’s happening?

Underlying grievances tied to inequality, the cost-of-living crisis and broader disenfranchisement, the lasting economic effects of COVID-19, and Russia’s invasion of Ukraine, have elevated SRCC risks and caused a historic reset in the political violence (PV) insurance market.

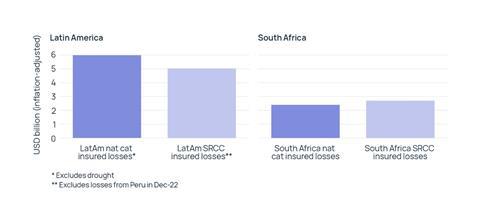

Recent unrest in South Africa and Latin America has seen the value of strikes, riots and civil commotion (SRCC) claims rival or even surpass major natural catastrophe losses, according to a new report released by Howden.

The outbreaks of violence in Chile, the United States, South Africa and Peru reflect a highly dynamic and interconnected risk landscape.

These events saw violence spiral quickly to affect multiple locations and are indicative of rising discontent globally, as demonstrated by other incidents of unrest last year in Iran, Kazakhstan, Sri Lanka and Argentina.

2023 has offered little respite, with protests in France and Israel hitting the headlines in recent weeks.

What does it mean for risk managers?

The ongoing turmoil has reset insurers’ views of risk. Property insurers are increasingly withdrawing SRCC cover whilst risk appetite in the standalone market has reduced significantly.

The fallout represents something akin to a perfect storm – demand up, supply down, triple-digit loss ratios and reinsurance retrenchment – resulting in a market-changing pricing correction.

Market pressures have been compounded further by the war in Ukraine, which in addition to causing one of the largest PV losses ever, has also exacerbated cost of living pressures and exposed other geopolitical risks.

The increased frequency of severity has propelled the quantum of SRCC claims in South Africa and Latin America to rival or even surpass natural catastrophe losses.

”Such devastating losses have precipitated a correction in the PV market that looks set to persist for some time to come.”

This is not down to a lull in catastrophe activity – both territories experienced a number of sizeable natural disaster losses during this time (including record-breaking floods in South Africa) – but a reflection of the unprecedented scale of civil unrest.

Conditions have unquestionably become more difficult, but few areas of (re)insurance have such an innate ability to respond to a rapidly changing threat landscape.

The step-change in losses and demand will require the market to scale up considerably over the next few years.

Tom Bradbrook, Executive Director, Howden Specialty, commented: “Such devastating losses have precipitated a correction in the PV market that looks set to persist for some time to come. Clients can therefore expect to continue to encounter difficult market conditions in 2023.

“For the cover that is most sought after currently – namely SRCC and full PV – line sizes are being cut across the board and certain risks are difficult to place, especially in more volatile areas.

“Rates are up for all perils and territories, with our pricing index showing an average increase of 80% since 2018.”

What next?

Bradbrook says that risk transfer advice can make a crucial difference to renewal outcomes for organisations.

He added: “With little prospect of a let up in market conditions, sector expertise, market-leading thought leadership and unrivalled relationships with insurers have never been more important.”

No comments yet