- Home

- Risk Type

- Risk Management

- Sector Risks

- Latest Edition

- SR.500 Exchange

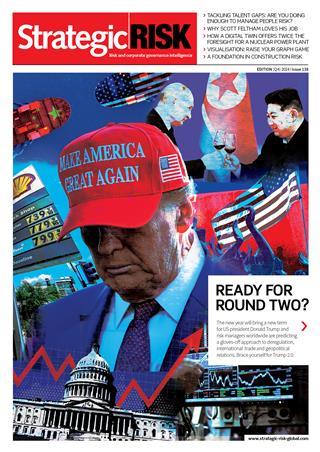

Are you ready for round two? What we know about Trump’s second term so far

By Trevor Treharne2024-12-19T13:46:00

As Donald Trump prepares to re-enter the White House, risk managers are trying to predict what upheaval awaits. Expect regulatory rollbacks, a return to his controversial approach to international relations, and an ‘America First’ economic approach that may put global trade in a tailspin.

For continued access to free content, you need to register. (If you’re already registered, please sign in here.)

REGISTER NOW FOR FREE

We’re glad you’ve chosen StrategicRISK as your essential source for risk management insight and hope you’ve been enjoying our content.

Gain access to our full archive of flagship quarterly digital issues, packed with strategic insights, market commentary, and opinion from leading risk management professionals. Registering is quick, easy, free, and will also have the additional benefits:

- Uncover Critical Insights: Dive deep with exclusive annual reports, fuelled by expert analysis on topics like climate change and industry trends.

- Stay Ahead with Expert Analysis: Award-winning coverage and analysis, delivered directly to your inbox through our newsletters.

- Curate Your Knowledge: Build a personalised library of essential articles and reports for quick reference.

- Access Premium Content: Unlock our full archive of in-depth articles, case studies, and expert opinions.

We also offer a dedicated print subscription.

LEARN MORE

- Sign In

- Forgotten Password

- Contributors

- Feedback

- Media Pack

- © StrategicRISK 2025

Newsquest Specialist Media

registered in England & Wales with number 01676637

at The Echo Building, 18 Albert Road, Bournemouth,

England, BH1 1BZ - a Gannett company

Site powered by Webvision Cloud