Joint ventures, local government engagement and gradual investment are all popular tactics for risk managers

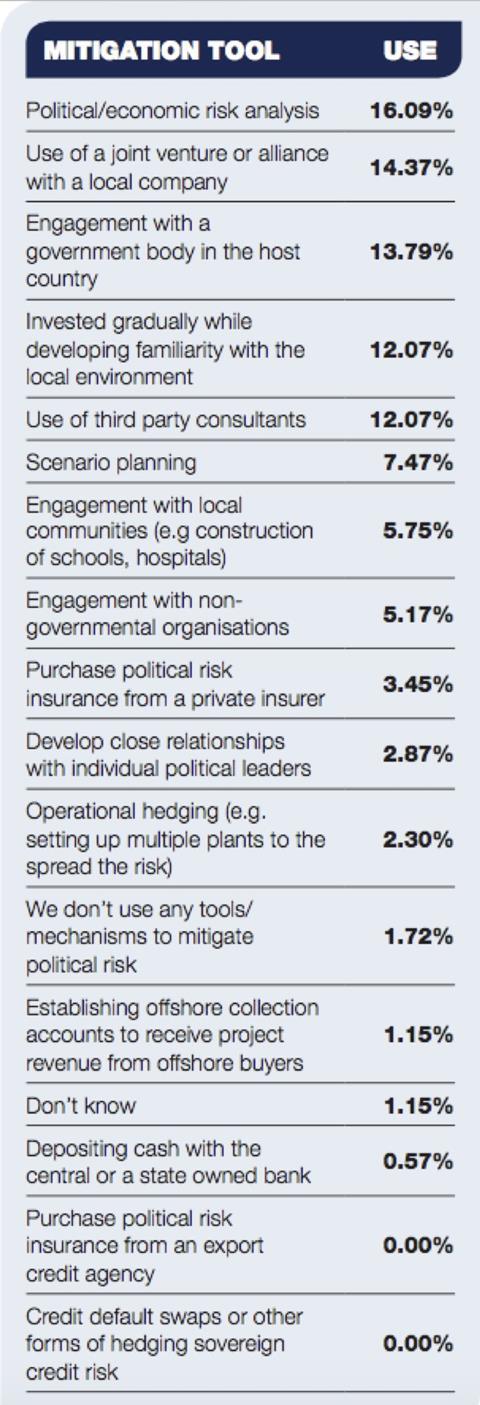

The most commonly used tool to mitigate political risk exposure is a thorough political/economic risk analysis, according to StrategicRISK’s The Knowledge survey on political risk.

This was closely followed by the use of a joint venture (JV) or alliance with a local company, or engaging with a government body in the host country.

But the results for mitigation were spread fairly evenly across the options for tools and mechanisms (see table, below), which suggests there is no one-size-fits-all approach to mitigating political risks.

Control Risks director of global risk analysis, Asia-Pacific, Steve Wilfred said that regardless of the tools or mechanisms used, firms operating in politically unstable countries needed to factor in additional costs for political risk mitigation.

“A thorough joint venture analysis of your potential partner is crucial and a recognition that you’re going to have to devote seemingly disproportionate resources simply to manage the political risk on a day-to-day basis. You have to cost that into your business plan,” he said.

Vingroup chief risk officer Thu Ly said an understanding of a country’s political landscape should shape how a business structures its operations when it is considering entering a new country.

“For example, at an early stage, [a company could] set up a JV with a local partner or state-owned partner with a small amount of capital. After 10 or 20 years, when [the firm] sees a positive change in regulations and stable political conditions, they can expand the business and put more capital in and withdraw from the JV to establish a 100% foreign-owned company,” she said.

“There is still a need to put in place a holistic and systematic approach to managing your risks. To ensure your risk management system can effectively and continuously scan the horizon for emerging risks; political, social, economical risks. To also have a simple yet robust business continuity management system to manage the disruptions and crises impacting your business from social upheavals leading to political changes to political changes causing social upheavals.”

Steven Lau, business continuity planning manager, Hong Kong Airport

Lockton Asia-Pacific director and head of political and credit risks Mark Thomas agreed that JVs could be a useful political risk mitigant.

He added: “Engaging with local government is essential and even local NGOs can be useful. On large investment projects, we like to see an environmental and social impact report showing what improvements the project has made to the local community and its potential effect. Many large political risk problems start as small, local problems.”

Danny Chan, director, global safety and security, Marriott International said a company needed to have a large risk tolerance to operate by itself in a foreign land.

“Trying to transfer its risk by going into a joint venture or better understanding the new markets by engaging the local government would certainly reduce the level of risk going into a new market,” he said.

PARIMA chairman and International SOS group general manager, risk management and insurance, Franck Baron agreed that “information is key when it comes to political risks”.

“There is no relevant risk management approach without this fundamental. Hence the need too for the right connections locally to learn and understand the local conditions. Strategic vision and ambition is key for businesses but should be coupled with a fair degree of humility about other territories,” Baron said.

The Knowledge: Political Risk in Asia-Pacific

This article appeared in the StrategicRISK The Knowledge supplement on Political Risks. To read the full supplement, including the results of an exclusive survey of Asia-Pacific risk managers, click here.

The Knowledge is sponsored by Zurich.

No comments yet