US property/casualty insurers overcharge policy holders and underpay on claims, said a report from a consumer association that an industry group called ‘absurd’

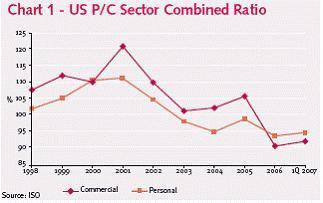

The Consumer Federation of America (CFA) has released a new study concluding that the property/casualty insurance industry continued in 2007 to systematically overcharge consumers and reduce the value of insurance policies, leading to near record levels of surplus.

An industry group said the insurer’s financial strength was good news for consumers and called the report ‘absurd.’

Former state insurance commissioner, J. Robert Hunter, the director of Insurance for the CFA and author of the study, said: ‘Unfortunately, a major reason why insurers have reported record-high profits and low losses in recent years is that they have been methodically overcharging consumers, cutting back on coverage, underpaying claims, and getting taxpayers to pick up some of the tab for risks the insurers should cover.’

“A vibrant insurance industry is vital to hold down rates and increase competition for consumers.

Carl Parks, National Association of Mutual Insurance Companies (NAMIC) senior vice president for government affairs

In the last several years, insurers sharply increased premiums for homeowners and commercial insurance and reduced or eliminated coverage for tens of thousands of Americans in coastal areas, said the CFA. Adding, insurers have succeeded in convincing Congress to continue taxpayer subsidies for terrorism losses and are seeking additional subsidies for catastrophe insurance.

Carl Parks, National Association of Mutual Insurance Companies (NAMIC) senior vice president for government affairs, said: ‘A vibrant insurance industry is vital to hold down rates and increase competition for consumers.’

Parks added that auto and homeowners insurance rates have declined in most areas of the US, coastal regions and some states like Florida being the exception. ‘Most experts believe that insurers have under-priced property insurance historically in states prone to hurricanes, in part because of models that underestimated catastrophe risk, but also because of government rate suppression,’ he said.

No comments yet