The traditional use of heatmaps is useless and flawed but more sophisticated risk charts could be applied to better track the likelihood of meeting targets, writes Hans Læssøe, principal consultant at AKTUS and former risk manager of The LEGO Group

In the risk management profession, there are a lot of people and risk management functions that still rely on the traditional heat-map or risk matrix where the assessed impact and likelihood for each risk is mapped as points in a chart like the one shown here.

This traditional use of heat-maps is essentially useless as well as directly flawed for a number of reasons:

- There is no real overview in knowing that you have (in this case) six “red” risks – it does not tell you about your consolidated exposure. The chart is useless.

- Each risk can have a range of outcomes if they materialize – and hence illustrating these as single points is flawed.

The assessed impact and likelihood are often interlinked where the higher impact generally has a lower likelihood and vice versa.

On top of this, too often these risk matrices are often used with biased scales from “very low” to “very high” where assessments are emotionally found rather than measured.

However, the graphic simplicity still appeals and hence the approach has proven hard to “kill”. I have worked a lot both for/with executives, and I know and understand the value of simple graphics … so over time, the notion of a heat-map has made me look for a better way to use these.

This led to a couple of findings:

- Executives and leaders do not really care about risks – nor should they. Their focus is driving performance, however, that is being measured and through that meet targets and aspirations set by superiors or boards.

- Risk managers focusing on managing risks are, hence, not truly relevant to leaders unless they change the way they address and communicate/report.

This line of thought has, supported by input from peers, led to a need for change in the way risk managers measure and report. Do not measure risks – measure performance! With the risks and opportunities that are facts of life – there will always be some level of certainty/probability that the company will meet this or that target.

For projects/initiatives/strategies, the targets are often in terms of deliver “this” by “then” spending no more than “that”. In many cases, the “this” is non-negotiable. The end product/deliverable must meet defined criteria for the project outcome to be approved. If these criteria are not met, the project is asked to redo or adjust until targets are met.

This leaves the performance monitoring of time and money. To include the notion of uncertainties, we can validly report on the likelihood of meeting targets in terms of delivering by the project deadline and keeping spending within budget.

Using risk management methodologies of what may affect delivery on time or spending, and consolidating the portfolio of risks and opportunities as well as general uncertainties using Monte Carlo simulation, this can rather easily be modelled/calculated at any point of time in the project.

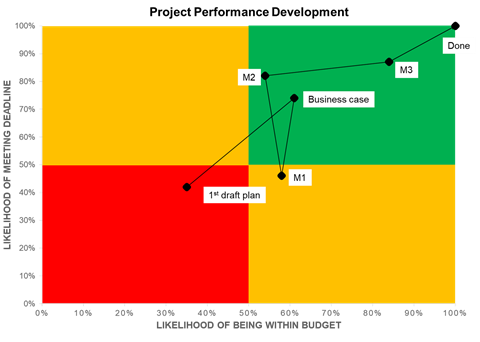

So – the valuable heat-map shows the likelihood of meeting timing and cost targets, and in this example is simplified to state that “below 50% likelihood is not acceptable”, which would lead to this performance matrix for a “mock-up” imaginary project.

This chart shows, that when we set out to do this project (1st plan), we didn’t have adequate control and was less likely to meet either target, which is deemed unacceptable (red). The team worked with the plan and the budget, and delivered a business case with about 60% likelihood of delivering within budget and 75% likelihood of meeting the deadline. Based on this – the project plan was approved.

Then – something bad happened prior to milestone 1 (M1) and the likelihood of meeting the deadline was in jeopardy to the extent it was in the “amber” zone of missing one of the two targets. On top of this, the likelihood of being within budget was reduced slightly as well.

The team focused, and opted to spend more, and hence further decrease the likelihood of being within budget – in order to increase the likelihood of meeting the deadline, which at Milestone 2 is now back in the approved (green) zone.

Between M2 an M3 a lot of risks fell out as these did not materialise and other uncertainties were reduced as well – leading to a comfortable position at M3 with almost 90% certainty of being within budget as well as delivering on time.

This is a good story, so the project did deliver – and the steering committee was consistently kept informed using the valuable heat-map as reporting tool.

Naturally, this approach can be equally applied if targets are e.g. environmental and staff motivation or reputational and brand value based or whatever parameters are relevant. All it takes is an underlying risk management, which identify and address risks and opportunities vis-a-vis such targets – using the performance metrics of the business.

Then we meet the project manager, who has a range of simultaneous targets to meet – which by the way is often the case with strategic aspirations. In such cases, measuring two parameters is inadequate, and does not provide leaders, nor the board, with the information they need to drive and direct the company going forward.

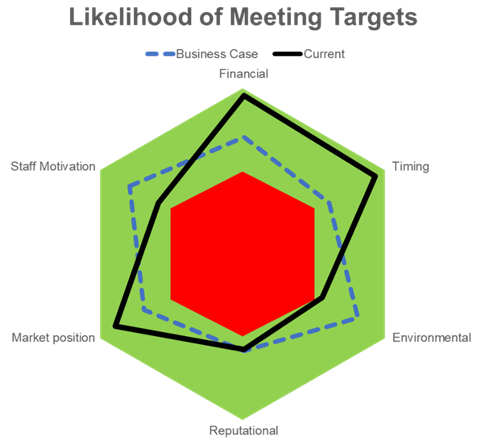

To solve this kind of situation, we may adopt more complex graphics like a spider chart (below).

In this example, the company has six strategic objectives – and wish to monitor performance vis-a-vis meeting these targets. Again – applying that risk managers report on the likelihood of meeting targets, it may look as this chart – again, where less than 50% likelihood is (red) unacceptable.

The blue dashed line is the Business Case or strategic planning document, which was approved by the Board – and which showed a reasonably balanced performance across the six parameters.

Half way down the line, the “current” (black line) status indicates that the likelihood of meeting the harder business targets such as financial, timing and market position targets have a very high likelihood … to some extent at the expense of a lower (but still approvable) likelihood of meeting the softer environmental, reputation and staff motivation targets. Even with this – the Board and Executive Committee can discuss whether this is the right focus for the company.

Yes – one can define other reporting approaches showing the likelihood of meeting targets, as well as means to report on the variances on such targets. These tend to being more complicated to read, and hence less valuable as executives and boards look for simplicity allowing them to focus on their discussion and direction setting rather than looking at “numbers”.

No comments yet