Continuing political instability, problems with economic sanctions and widespread corruption are all hampering a return to business as usual in Libya

After a long and determined struggle by rebels the Gaddafi regime, which ruled over Libya for four decades, has fallen. In response, oil giants, like France’s Total, haven’t hesitated to resume production in the oil rich North African country. Nevertheless, stability in the region and therefore the risk outlook is still difficult to assess.

The situation in Libya can be described in one word: “non-transparent”. While some companies are clearly seeing an opportunity to resume operations, others are holding back. Businesses should consider the following points:

1. Political instability

Sooner or later the interim government will be forced to resign, creating uncertainty. What’s clear is that the current interim governing council is prone to quarrelling and in-fighting, leading to postponements and delays. The current situation makes long term planning very difficult.

2. New sanctions

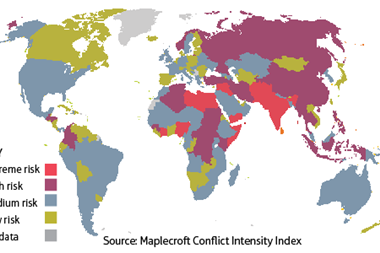

“From a regulatory point of view, the EU continues to list sanctions on Libya,” says Maplecroft’s risk analysis specialist for Libya Jonathan Terry. The EU has begun to repeal some of the sanctions that it imposed on Libya—which were put in force to weaken Gaddafi—but sanctions still pose a serious reputational threat for companies. It’s likely to be some time before the picture is entirely clear.

3. In the aftermath: Corruption

In Gaddafi’s Libya the only way to rise into a position of managerial authority was by being somehow linked to a family member or a supporter of the regime. Now Gaddafi has gone some workers are demanding that former regime loyalists be punished.

“If you’re trying to build up a business relationship with a company you may very well be dealing with people who have links to Gaddafi. Does that mean they’re corrupt? I’m not so sure. Does it mean that they might be removed from power? That’s a possibility,” explained Terry.

Corruption will continue to be a major problem in Libya for some time to come posing a huge reputational risk for foreign companies, particularly those involved in joint ventures.

No comments yet