In the first of a series of online regional risk profiles, James Bray explores the risks and opportunities of investing in sub-Saharan Africa

Sub-Saharan Africa is already a key growth area for many multi-nationalsand it is attracting more investment every year. According to a report by the OECD and the African development bank average economic growth for the region is expected to be above 5% in 2011.

Impressively, GDP in sub-Saharan Africa has grown by around 5% every year since the mid-90s and as the market is still in the early stages of development competition is limited.

The three most important economies in the region are Nigeria, South Africa and Kenya and this is where the capital markets are most mature. “Foreign companies looking to expand in Africa tend to enter these markets before moving into the rest of Africa,” said Natznet Tesfay, head of Exclusive Analysis’ Africa forecasting team.

As the African economy is largely dependent on commodities it was hit hard by the downturn in the global economy. Eastern Africa best weathered the crisis and is expected to have economic growth of more than 6%.

“I would suspect that GDP is expected to increase most in east Africa because it has not traditionally been an oil or mineral exporting region (although Uganda is expected to come online for oil next year). Also, Kenya and Tanzania have off-shore exploration work going on and all three countries are looking to develop their mining industries,” said Tesfay.

Political issues

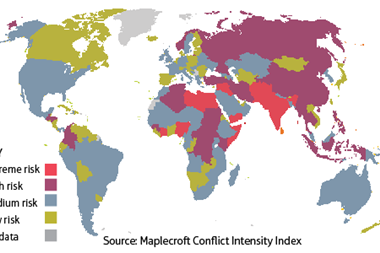

East Africa also tends to have greater political stability than other parts of the continent making it more appealing to foreign companies (with the obvious exception of Somalia).

In general, political instability is a serious issue in Africa as the collapse of a regime can leave companies in limbo. Contracts and operating licences can be rendered void leading to business continuity problems.

“Companies have to know who the key political actors are which may not necessarily be the politicians, but could be anyone from the military to the academic community and other groups that are less obvious to someone who is entering the market. Knowing who these key players are allows a company to understand how the business culture operates,” commented Tesfay. “The key risk for companies entering the African market is contract cancellation stemming from a lack of understanding of who the political actors are.”

Sub-Saharan Africa is well known as a difficult place to do business and knowing who is in charge of the bureaucracy allows a company to be more efficient.

Bureaucracy

Logistical issues can often stall companies who are looking to expand their business in this region. For example, checkpoints on African roads increase transport costs and cause delivery delays. They also limit the free movement of commodities, people and investment.

Border crossings can be even more difficult as they often require lots of documentation. Infrastructural problems may also deter investors from moving into the region.

A lack of familiarity with the complex web of markets that make up sub-Saharan Africa could prove to be very challenging. However, African countries are also becoming much more aware of the fact that these problems can deter foreign investment.

“This is why you’re seeing big flagship infrastructure projects going through, whether it’s the southern Africa integrated rail system or east Africa integrated power grid,” added Tesfay.

In order to win a licence to operate, companies often need to enter into a contract to help establish infrastructure for the country involved. “Promising to establish key infrastructure projects definitely tips the balance in the company’s favour,” commented Tesfay.

“This strategy has been most aggressively pursued by China in the West African mining countries such as Guinea, Sierra Leone and Liberia as well the southern African region,” she added.

Corruption and Bribery

Infrastructure projects can prove particularly problematic and there is a lot of scope for corruption. China International Fund, a huge Chinese company that trades and invests in developing countries, has been criticised for allowing billions of dollars meant for schools, roads and hospitals to end up in private accounts.

Corruption and bribery is endemic in certain parts of Africa and bribery laws have changed in the UK and Europe so companies need to proactively avoid any illicit behaviour. Any accusations of corruption and exploitation could have serious financial and reputational consequences for foreign businesses.

Emerging market investors

Foreign trade and investment from developing economies such as China has an increasingly important role in boosting African GDP. “People think of China as the only Asian country involved in Africa but Japanese and Indian companies are also involved in significant projects on the continent,” added Tesfay.

Other emerging economies such as Brazil and Russia are also beginning to compete with China on bids. A large share of foreign businesses operating in the region tend to come from developing economies. “You see more Chinese, Japanese and Indian multi-nationals in sub-Saharan Africa. This is perhaps because they are less risk averse and better able to deal with a developing market than their European or American competitors,” added Tesfay.

Although trading in commodities is fundamental to the African economy, it is not the only source of wealth for the continent. “Outside of the traditional sectors such as mining and oil and gas, you find a lot of investment is going into the continent in agriculture, telecoms and services. Even the relatively less mature economies are diversifying, which you see now in countries like Ethiopia and Rwanda,” according toTesfay.

As growth in Europe stalls Africa could represent a big prospect for many companies. Businesses may want to think about harnessing these opportunitieis before it is too late.