We all need to set priorities but when we need to speak about actions at company level, with the focus on performance transformation and stakeholder value, have we really analysed what this actually means? Adrian Clements, international enterprise risk manager, has these tips

How to prioritise actions

To set the picture I will assume that we wish to improve performance and the key parameter being measured is EBITDA. The second criteria I will set is to identify opportunities in the company to increase EBITDA and thirdly understand how vulnerable am I to loosing this money?

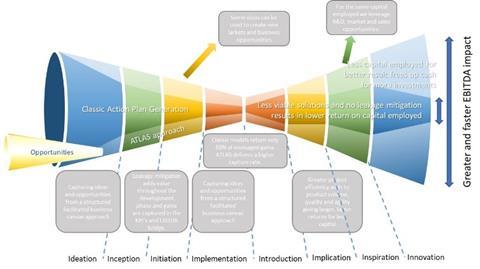

Figure 1: Results improve with information

Using this graphic you can see that I need to setup a process to capture more ideas. The target is more likely to be achieved. However, there are some ideas that will generate growth but make the company more vulnerable, i.e each action I take will affect in some way either the growth or level of vulnerability. This applies not only to operational actions but also to managerial decisions like HR, legal, purchasing, insurance, supply chain etc.

Each captured action is quantified by controlling indicating the impact each has on EBITDA. This will create the benefit of each action. The second parameter, vulnerability, is more difficult to quantify but there will also be a vulnerability benefit from each action. This approach plays a key role at two levels.

- It captures new ideas for EBITDA growth

- Is reduces EBITDA leakage on which the growth is based. Ie making it more sustainable

Figure 2 ATLAS knowledge management

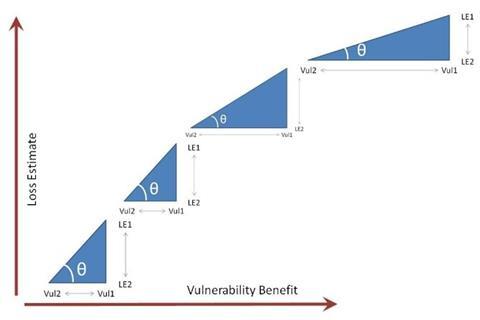

However there are many elements affecting the priority strategy. If I take the maintenance managers view then he wants to reduce frequency issues as these are driving his KPI. Ie repair and maintenance cost reduction. The insurance consultant who visits our plants and makes viable recommendations has a slightly different goal, to reduce the claims severity. The operations manager wants tonnes.

So:

- You need to establish your mitigation strategy before you can address priority.

- You need to eliminate vulnerability before building a growth strategy. Or have a bigger risk appetite.

Risk exposure is rarely included in prioritisation. But can be influential in reducing EBITDA leakage. Let me give an example. How often can your plant burn down per year? Let’s say once. How often will a pipe break or a pump fail? Let’s say once per week. Each failure will impact variable and fixed costs. There will be quality issues and management costs incurred. There are therefore events or risks where the frequency issues, taken over a 12 month period, are more expensive than the single event. The cost of the action to mitigate these events will have synergies that need to be taken into consideration.

Figure 3 Vulnerability biased action strategy

Taking the example of a steel manufacturer we have typically a single hot rolling mill for converting slabs into coils. But we might have 2 or 3 blast furnaces or 2 or 3 cold rolling mills. The inherent risk of the blast furnace is higher than the hot rolling mill but I have three of them so production can continue if one fails. With the hot rolling mill, it’s different. I have only one. If it fails that’s it. So, we have business continuity effects and inherent risk levels which need to be taken into consideration when establishing the strategy of reducing severity or frequency in my action implementation strategy.

However putting into place a process safety management system will impact vulnerability levels on both processes.

More and more you see the input of the industrial accountant is becoming key. They understand and can calculate the value created at each stage of the process and the consequence on EBITDA sustainability of each action planned.

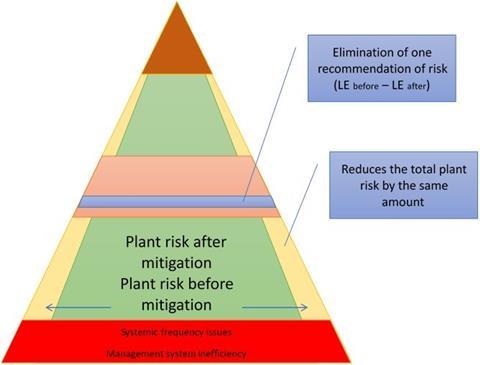

The result will be the most financially efficient way to move the company risk level from one point to another lower risk state.

EBITDA is therefore captured in two steps by the correct prioritisation method.

1. A risk initiator is eliminated so that we can build on this EBITDA gain

2. The Heinrich triangle base is transformed. This reduces the probability of other significant events taking place in the future as the root cause for these events is reduced. This increases the likelihood of achieving the EBITDA targeted in most budget processes.

Figure 4 EBITDA leakage capture- Heinrich

Inset is the actual Heinrichs triangle of a large industrial company. Solving key management issues will significantly reduce EBITDA leakage. The bottom band of cash out.

I will show in the next article if the correct action is taken and the driver trees correctly chosen then the systemic risk catalyst will be eliminated and so the value to the company will be greater than only EBITDA growth.

- Of course know what risk management is?

- Where’s all our money going?

- Trees creating transparency

- Barriers creating openness

- The playing field is not flat!

- What do you mean I’m the owner

No comments yet