Global supply chains are becoming more vulnerable in more countries, say political risk analysts

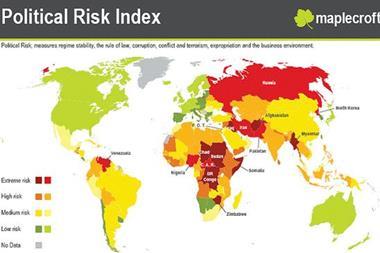

Global supply chains are becoming more vulnerable to potential disruption to trade in 42% more countries in 2009 than last year, said Aon.

The number of countries with the 'supply chain vulnerability' icon on Aon’s political risk map has increased from 38 to 54 due to risks ranging from government embargo or interference with a supplier through to strikes, terrorism and sabotage.

Companies most at risk are those that rely on:

Commodities – as nationalism grows, especially around oil

Manufacturing – if a company is reliant on time-sensitive production, tailored inputs or a single geographical source

Outsourcing – the move from west to east to lower costs, for example, through call centres or software teams.

Political risks could impact companies by causing lost or damaged assets, lost revenues, unexpected or unbudgeted expenses such as expediting costs and contractual penalties.

Roger Schwartz, senior vice president of Aon’s political risk team, commented: ‘Good business continuity planning can be supplemented by political risk insurance that will pay out for replacement costs, asset value or daily costs incurred. The list of perils can be tailored to cover gaps in other insurance covers – for example, property damage under business interruption must be physical, not as a result of a political action.’

Alex Hindson, head of enterprise risk management at Aon Global Risk Consulting, added: ‘The key to managing supply chain risk is to gain an understanding of the risks. Mapping key supplier dependencies is the first step in taking control of the risk exposures. By identifying single point failures and quantifying exposures, organisations can take conscious decisions to mitigate exposures. Mitigation might include multiple sourcing, safety stock holding, consignment stock or business continuity plans based on rerouting manufacturing through alternative manufacturing facilities. As always plans needs to be put in place and tested prior to the event to be any guarantee of supply chain resilience.’

See the next issue of StrategicRISK (February 26) for a Special Report on Supply Chain Risk Management.

No comments yet