A StrategicRISK survey shows European risk managers have a different outlook to their Asian, and global, counterparts

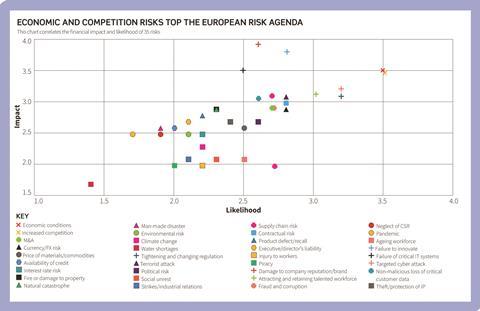

Increased competition is the biggest risk facing European businesses in the coming year, with a combined risk score of 3.53 out of a possible five. That’s the headline finding of a StrategicRISK survey.

A close second on the top 10 risk list for Europe is economic conditions (combined score: 3.51), followed by failure to innovate (3.27) and damage to company reputation or brand (3.22). The risk of a targeted cyber attack (3.19) rounds off the top five.

Nearly 50 European risk managers responded to the exclusive survey, ranking the risks of both likelihood of occurrence and financial impact.

Of these, 25 said increased competition was likely or highly likely to occur. Meanwhile, 24 said economic conditions were likely or highly likely to have an adverse effect on their business in the coming 12 months.

Global differences

Damage to company reputation or brand topped the list when it came to financial impact, with failure to innovate in second place.

By and large, economic risks keep European risk managers up at night (see page 28). The risk landscape looks different, however, from a global perspective.

Research from the World Economic Forum (WEF), The Global Risks Report 2016, found that large-scale involuntary migration and extreme weather events were the most likely to occur, while failure of climate change mitigation and adaptation was deemed to be the top risk in terms of impact.

Margareta Drzeniek-Hanouz, lead author of the WEF report, told StrategicRISK that economic risks were still a concern on the global scale, but that other societal considerations were pushing risks such as migration and climate change further up the risk agenda.

“Economic risks generally remain high on the agenda, albeit not as the top risk,” she says. “But they should not be underestimated as they remain very important and impactful. There is definitely an underlying long-term concern about economic risk.

“This has been the case over the last few years since the global financial crisis. There is a sense that we are not really addressing those the way we should and they are therefore persisting in one way or another.”

She adds: “Asset bubbles have shot up considerably compared to two or three years ago, and that is clearly another concern.”

Airmic chief executive John Hurrell says risks fall into one of two categories: internal risks resulting from the failure of company processes and external risks that are the result of unforeseen occurrences.

“The first category will be managed to the best of the ability of the board and management of the company in the light of their (hopefully well-informed) market intelligence and the deployment of their own resources,” he says.

“However, the second category requires analysis and intelligence (a good risk radar) but, most of all, the ability to respond effectively and rapidly. It is not necessary for most businesses to analyse the relative probabilities of various externally triggered risks, provided that they know how to react should they occur. Crisis planning will be more effective in practice than risk analysis.”

To help ensure internal processes are suitable for the business’s needs, and to ensure it is prepared for any unforeseen circumstances, FERMA president Jo Willaert says companies must ensure risk managers are properly embedded within the organisation.

“It is really important that the internal structure of an organisation defines who the risk manager is working for,” he told StrategicRISK.

“A risk manager should be high-level enough to be part of, or at least support, the decision-making process of the company. He should be there when the strategic options are set out and to give his technical opinion like other disciplines such as financially responsible senior executives.

“It is obvious that these senior executives are close to the decision-making process and that when they say something, it is taken into account. It is often not so obvious for the risk manager.”

The view from Asia

In 2015, StrategicRISK conducted a survey of more than 145 of Asia’s top risk professionals to get a view of the biggest risks facing organisations in the Asia-Pacific region.

Top of the Asian risk agenda was the economic landscape, with a combined risk score of 3.45. While this is lower than the 3.51 score for European economic conditions, it is still enough for it to take the top spot in the Asia-Pacific survey, with the second and third spots going to, respectively, attracting and retaining a talented workforce (3.09) and increased competition (3.06).

A targeted cyber attack, which was the fifth-biggest risk in the European survey, was of increasing concern for Asian risk managers, climbing from ninth spot in 2014 to fifth in 2015 with a combined risk score of 2.84, compared to 3.19 in the European survey.

Another threat climbing the risk ladder in Asia was a company’s failure to innovate, breaking into the top 10 for the first time with a combined risk score of 2.84.

Daniel Tan Kuan Wei, second vice-president of the Risk and Insurance Management Association of Singapore and convenor of Singapore’s National Risk Management Working Group, says he was surprised that the risk manager community had taken so long to appreciate this risk.

It should have already been in the list, he says. “This is absolutely critical for organisations to constantly produce new products or services that meet customers’ needs or innovate internal processes to be more efficient and agile.”

Interestingly, European risk managers ranked failure to innovate much higher on the risk spectrum, with a combined risk score of 3.27 taking it to third spot on the list of Europe’s biggest risks for 2016. The risks that least concern Asian risk managers coincided with the European view of the risk landscape. Water shortages and piracy made up the bottom two of both StrategicRISK surveys, with likelihood risk scores of 2.0 or less.

No comments yet