Willis’s Azzizza Larsen explains why political and trade credit risk solutions are in high demand for Nordic multinationals

A month into her new role as head of Willis’s new financial solutions specialist unit, Azzizza Larsen spoke to StrategicRISK about the firm’s vision for growth into the Nordic region and the risks facing multinationals.

Larsen was appointed financial solutions executive director following a seven-year spell at Willis’s financial solutions practice in London. She now heads a new division from her office in Copenhagen, where she will provide clients with bespoke political, terrorism and trade credit solutions.

Larsen is excited to lead Willis’s financial solutions expansion into the Nordic region not least because of the challenging risk landscape for multinationals, which is driving demand for political and trade credit solutions.

She said: “Nordic multinationals have become increasingly international and are doing more business in emerging markets, which means they have had to consider global risk factors to a growing extent.”

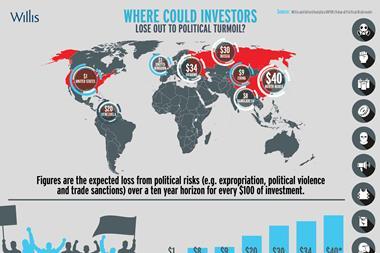

One major threat to businesses in the region is the political risk landscape, which is constantly changing. Increased dependency on emerging markets such as Russia and China means Nordic firms must be alert to political tensions in jurisdictions in which they operate.

Larsen said the ongoing crisis involving the Ukraine and Russia could affect Nordic companies as potential economic sanctions by the EU are likely to disrupt trade between the Nordics and Russia, an important trading partner.

“Nordic companies will be bracing themselves for what could become an ongoing stand-off between Russia and Europe in relation to the Ukraine.

“If there is continued uncertainty and the EU decides to impose wider economic sanctions, it will affect Nordic companies because Russia is one of the two largest emerging market trading partners together with China for the Nordic countries, particularly in Finland and Sweden.”

Larsen compared the current situation to the consequences of the Arab Spring for Nordic companies.

Nordic exporters were affected by the political turmoil in 2010 and 2011 as trade with the Middle East was disrupted. Larsen said this helped raise awareness among Nordic corporate of the political risks linked with doing business in emerging markets. As a result, Nordic multinationals are showing an increased appetite for political risk solutions.

She said: “The Arab Spring affected Nordic companies exporting to the Middle East, thereby helping to increase awareness about political risks in this part of the world.

“There has been an increase in demand for political risk and trade credit insurance in the region in the past five years owing to this and the global financial crisis, among other reasons.”

This demand was an important factor in Larsen’s appointment and Willis’s overall strategy to further spread the availability of its specialist insurance solutions by reaching out to the Nordic market.

Larsen aims to assist Nordic multinationals and financial institutions with mitigating the political, trade credit and terrorism risks they face in emerging markets by offering advisory services and bespoke insurance solutions.

She said: “We are seeking to establish Willis as a trusted advisor for political risk, trade credit and terrorism in the region. We have 800 employees in 14 offices across the Nordic region and will work in close co-operation with our local offices to provide a tailor-made and comprehensive specialist offering to Nordic clients.”

No comments yet