Risk managers in strategic and high-tech sectors must monitor efforts to decouple critical supply chains - Control Risks

The US-China relationship is the greatest geopolitical risk for businesses in 2023, according to Control Risks. US-China conflict remains very unlikely in 2023, but competition and confrontation are moving from the trade and technology realms into the military domain.

Neither side seeks nor is prepared for a military conflict in 2023, but both are striving to be ready for when a crisis comes. This includes military planning, diplomatic legwork, and domestic political conditioning.

Companies in 2023 must also be alert to the prospect of an accident or miscalculation involving US and Chinese military vessels operating in close proximity in Asia.

The frequency of such operations makes it more likely that there will be an incident, which would require careful diplomacy to prevent escalation into a security crisis. Deconfliction channels between the two powers are less effective than they were, making such diplomacy more difficult.

Selective supply chain decoupling

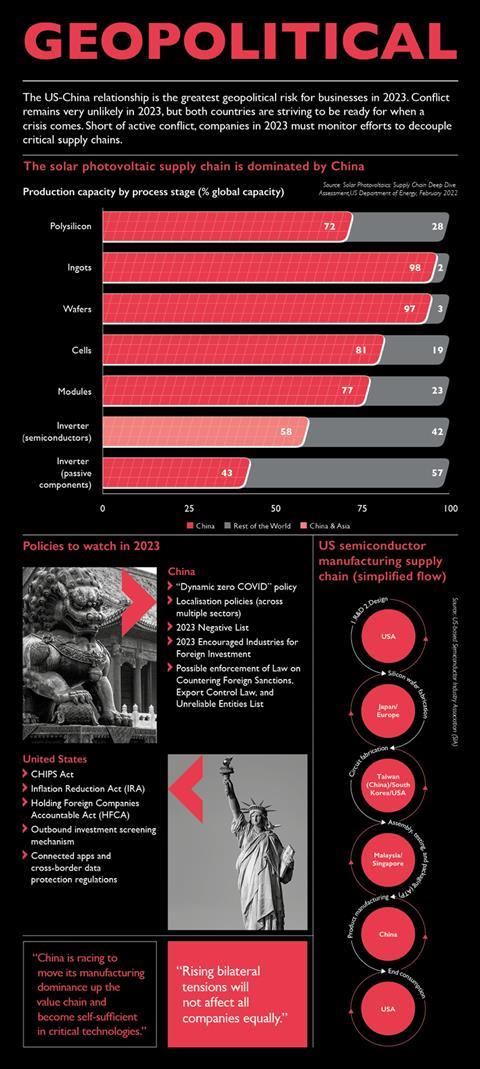

Short of active conflict, companies in 2023 must monitor concerted efforts to decouple critical supply chains, which will only accelerate as China and the US absorb and interpret the lessons of the conflict in Ukraine.

One lesson is that political and historical imperatives can easily override the economic interdependence that is supposed to deter conflict. Another is the risk of overreliance on geopolitical rivals for critical inputs, which several Chinese tech companies know only too well.

The conflict also outlined a playbook that will likely guide any future confrontation in Asia, namely how the US might try to wield its financial dominance, technological edge, and alliance system for geopolitical advantage.

With a raft of industrial policies and international initiatives, the US is making good on its pledges to re-shore and “friend-shore” strategic industries, like semiconductors, EV batteries, and critical minerals.

It is restricting China’s access to technology, capital markets and investment opportunities, as well as US companies’ ability to invest in advanced technology in China. Other Western countries are joining in more intensive scrutiny of China-based suppliers. Cross-border data protection laws are not far behind.

Click here to open the infographic

Compliance dilemmas

Likewise, China is racing to move its manufacturing dominance up the value chain and become self-sufficient in critical technologies, especially advanced semiconductors.

New laws and regulations aim to deter compliance with Western sanctions and other measures. After decades of biding its time and hiding its strength, China is assertively expanding its global diplomatic and security footprint, challenging the US’s positions in sub-Saharan Africa, Latin America, and the Middle East.

US, Chinese and other multinational companies, many of which have been uneasily contemplating these trends for years, will spend 2023 updating and accelerating their strategic planning on the basis that ten years have become five, and five have become two.

Mounting concerns about China’s growth prospects have also taken the shine off investment prospects.

Deteriorating relations guarantee that most bilateral trade and investment restrictions imposed during the US-China trade war since 2018 will remain in place in 2023, exerting continued pressure on investment decisions.

More recent US measures targeting advanced technology are also likely to drive a decline in US investment in China, especially in hitherto hot sectors like data analytics and artificial intelligence.

Policy restrictions and perceived political risks will likewise continue to deter Chinese investment in the US. The emergence of regulatory and compliance dilemmas for companies trying to do business in both countries seems closer than ever.

Nonetheless, selective decoupling is not full decoupling. Rising bilateral tensions will not affect all companies equally.

Those in strategic and high-tech sectors in both countries will face rising political risks; many in less sensitive industries will continue to operate under business-as-usual conditions.

No comments yet