Anyone who buys RSA would need deep pockets

It looked like it was finally going to happen.

RSA had long been considered a takeover target, so when Zurich said it was considering a 550p-a-share offer in July 2015, it looked like the company had finally found a match.

But the deal fell through, and RSA remains independent.

RSA is at least as attractive to would-be buyers now as it was before the failed Zurich bid, if not more so following the improvements the company has made to the business since then and the strength of its capital base.

But a deal now looks even more remote because the company is simply too expensive for most potential suitors to contemplate. Does that mean RSA will remain on the shelf, or could a suitor with deep pockets be tempted to make a swoop for the company?

A big ask

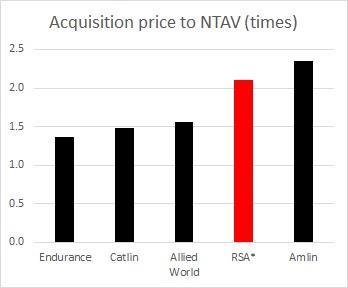

London-listed RSA’s shares are trading at 570p each – around 1.8 times the company’s most recently reported net tangible asset value (NTAV) of 312p a share.

*Based on theoretical price of 655.5p a share, which is current price plus 15% premium

Source: Company announcements/Insurance Times calculations

This on its own would be expensive enough, if that is all a would-be buyer would have to pay. But any buyer would need to pay a premium of at least 15% on top of the share price to encourage shareholders to sell up, taking any bid over two times NTAV. And some think the premium would have to be even higher.

Insurance companies rarely sell for more than twice NTAV (see chart). One recent example that did was Amlin, which went to Japanese insurance powerhouse Mitsui Sumitomo for around 2.4 times NTAV. But, as Panmure Gordon analyst Barrie Cornes puts it: “That was a relatively unique case.”

Shore Capital analyst Eamonn Flanagan says: “One you get into twice book value for a mundane company, albeit well positioned in Canada and Scandinavia, with a tough regulatory and competitive regime in the UK, it is a big ask.”

Cornes adds that the 570p share price is already “up to speed” with where he values RSA so it is unlikely that someone would pay that plus a premium. He says: “I can’t see a bid coming in at £6 or £7.”

But possible forthcoming changes at the company mean RSA could become more expensive. News reports suggest the company is close to selling its old UK liabilities, which would free up capital and potentially fuel a higher dividend. And the company has hinted at improved profits. Cornes says: “I think the share price will go up on the back of that.”

As can be seen from the world of insurance broking mergers and acquisitions, private equity houses are sometimes willing and able to pay higher multiples than trade buyers would.

RSA’s pension fund, which is thought to have been one of the barriers to previous deals, could preclude a private equity buyer. The pension position has improved – the fund had a surplus of £97m as of 30 June 2016, up from £64m at the beginning of 2016. But the presence of defined benefit pensions schemes makes private equity buyers skittish.

Flanagan says: “I don’t think the presence of the pension scheme is an obstacle to any sort of move from trade buyers, but I do think private equity baulks at any deals in our world these days with a pension scheme issue.”

Berenberg analyst Sami Taipalus adds: “RSA’s pension scheme issue has got a little better recently, but it is still something that could potentially turn into a fairly substantial black hole. You would have to be pretty big to take that risk on.”

Who would buy?

That leaves trade buyers. Obvious choices would be European big-hitters such as AXA, Allianz and Generali. Zurich itself might even be tempted to take another shot.

These players might be tempted by cost savings they could derive from merging areas where there is crossover – the UK being considered particularly ripe for this.

But the big question is whether they are interested, particularly at the current price levels.

This has prompted some to speculate that a buyer from Asia, such as a Japanese insurer or Chinese investment vehicle, could be interested. Japanese insurers have certainly taken an interest in buying Western firms. Sompo has already bought Lloyd’s insurer Canopius and is in the process of buying Bermuda-based global (re)insurer Endurance. Tokio Marine now owns US liability insurer HCC as well as Lloyd’s insurer Kiln.

Taipalus says: “If a Chinese investment vehicle wants to enter that space, they have proven themselves to be quite happy to pay fairly hefty multiples.”

But it is not even clear whether an Asian buyer would want RSA. A new entrant into RSA’s core markets of the UK, Scandinavia and Canada would not get the benefit of cost savings by merging the new purchase with existing operations. And foreign investors to date have been more interested in specialty businesses, such as Lloyd’s insurers, or life players.

Flanagan says: “I am not picking up that there is real appetite from Asia to try and dabble in the UK retail market.”

The consensus is that RSA will stay independent for now. But analysts are reluctant to rule out a bid entirely.

Berenberg’s Taipalus says: “In my view, the most likely outcome is that there is no deal at this price. Any acquirer would have to pay a pretty hefty premium on top of where we are already trading. But there is still a significant probability that there could be a deal.”

If chief executive Stephen Hester wants to sell RSA, he may be waiting for some time yet.

This article was first published by Insurance Times, StrategicRISK’s sister publication

No comments yet