Strong risk management could help companies gather capital at a lower cost

The economic downturn is an opportunity for risk managers to raise their profile within the organisation, according to attendees at the Italian risk management association’s annual conference.

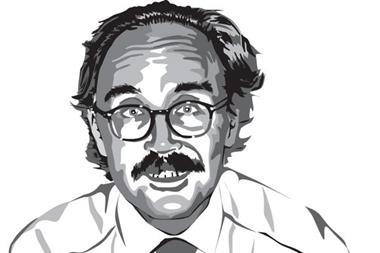

Paolo Rubini, vice chairman of the Associazione Nazionale dei Risk Manager (ANRA), told StrategicRISK that the crisis could be helpful in strengthening the position of risk managers.

‘Companies may sooner or later get evaluated by the banks or financial markets with respect to their risk profile. That means the existence of a strong risk management function could entail the possibility of gathering finances at a lower cost or interest rate,’ he said.

Also speaking to StrategicRISK at the event, Alessandro De Felice, group risk manager, Prysmian, said: ‘I think this could be an opportunity to develop a better risk management culture in Italy.’

“We are becoming part of the standing of the company and we are becoming part of the rating of the company

Paolo Rubini, vice chairman of ANRA

Now that money and liquidity are an issue the banks may look for additional guarantees from companies that their investments are safe, suggested Felice. He said the lenders may consider risk management an important element in evaluating the stability of a company.

‘We are becoming part of the standing of the company and we are becoming part of the rating of the company,’ said Rubini.

Standard and Poor’s, the rating agency, said in May 2008 that it would start including ERM in its credit ratings analysis for non-financial corporations.

No comments yet