All regions, except Latin America (9%), reported double-digit pricing increases, led by the UK (34%), Pacific (33%), and the US (18%) - Marsh

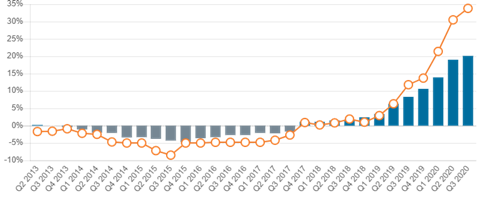

Global commercial insurance prices increased 20% in the third quarter of 2020, according to the Global Insurance Market Index released by Marsh. The increase, the largest since the index was launched in 2012, follows year-over-year average increases of 19% in the second quarter and 14% in the first quarter.

The average composite price increase of 20% was driven principally by property insurance rates and financial and professional lines. Among other findings, the survey noted:

- Global property insurance pricing was up 21% and global financial and professional lines were up 40% on average, both greater than the increases reported for the second quarter. Casualty pricing was up 6% on average, a slight drop from the 7% increase reported for the prior quarter.

- Composite pricing in the third quarter increased in all geographic regions for the eighth consecutive quarter.

- All regions, except Latin America (9%), reported double-digit pricing increases, led by the UK (34%), Pacific (33%), and the US (18%). Pricing changes in all regions were equal to, or greater, than increases reported for the second quarter.

- Public company directors and officers (D&O) coverages continued to see large increases. D&O pricing in the UK and Australia was up more than 100%, while pricing in the US was up nearly 60%. More than 90% of US public company D&O clients experienced an increase.

Commenting on the findings, Lucy Clarke, president, Marsh JLT Specialty and Marsh Global Placement, said: “Challenging conditions continue to exist across many parts of the insurance marketplace. Uncertainty, particularly related to COVID-19, and loss experience in many lines have both contributed to this three-year trend of increasing insurance costs.

”For many clients these conditions are occurring at a time when they can least withstand them, and are leading many companies to rethink their insurance buying patterns including increasing retentions, reducing limits, and modifying policy terms and conditions… we expect these challenging conditions to persist into 2021.”

No comments yet