Poor people management can have a profound effect on a business – hitting productivity, innovation and morale. More attention must be given to the roots of people risk if we don’t want the talent to run dry.

This article appears in the People Risks Report, produced in association with RSA. You can read the full report, which includes features and case studies, here.

The consequences of ignoring talent risks can be considerable.

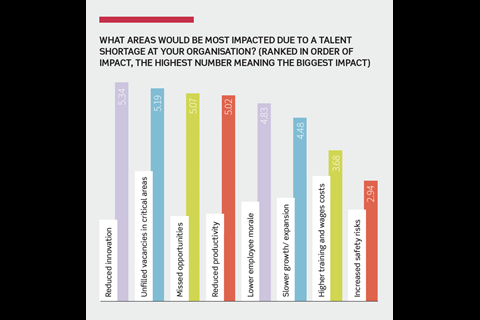

Our Tackling Talent Risk survey shows that the impacts businesses are most concerned about include reduced innovation, unfilled vacancies in critical areas, missed opportunities and lower productivity.

Of course, these threats can cause other significant risks for businesses. As Andrew Jones, director of risk consulting at RSA, says: “Clients experiencing challenges in recruiting and filling safety-critical roles raises concerns, as this increases the potential for a serious, if not catastrophic, incident occurring due to a lack of oversight, fatigue or distraction.”

Despite this, our research also reveals that businesses worldwide are failing to get a handle on talent shortages.

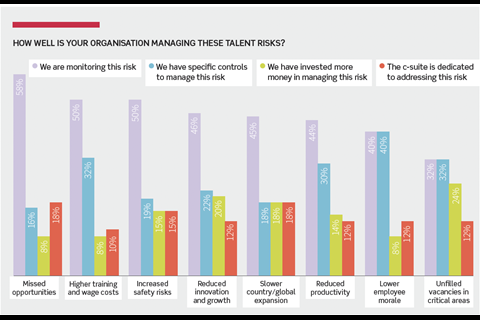

When we asked risk managers how they were tackling key threats, the results were stark. Just 50% or fewer of the risk managers we asked say that they are monitoring the risks of higher training and wage costs, increased safety risks due to talent shortages, reduced innovation and growth, slower expansion, reduced productivity, lower employee morale, and unfilled vacancies in critical areas.

In fact, the only risk area being monitored by more than 50% of businesses is missed opportunities due to talent skills gaps.

Franck Baron, group deputy director, risk management & insurance, at International SOS believes it’s critical for risk managers to put systems in place to evaluate how people and HR risks compare with other threats the business is facing.

“It is crucial to evaluate if these risks are getting the level of prioritisation and attention they deserve when the organisation prioritises its main risks and allocates specific focus and resources,” he explains.

Looking further down the funnel of risk management, the results were more concerning. Less than one-third of businesses were able to say that they had controls in place to manage almost all key risk areas, fewer than a quarter had invested money in managing the threats and fewer than 20% said the c-suite was committed to managing these exposures.

Baron says that risk managers need to ask if their business has established a fair level of collaboration with HR to help them manage their risks and the associated risk financing aspects, such as employee benefits.

He adds: “Effective collaboration is key to ensuring that these risks are adequately managed and mitigated.”

The risks where businesses were most likely to have controls in place included lower employee morale (40%), unfilled vacancies in critical areas (32%), and higher training and wage costs (32%).

Those where risk managers say the business has invested money in managing the threats included unfilled vacancies (24%), reduced innovation and growth (20%) and slower expansion (18%).

When we asked respondents to describe how people risks factor within their wider risk management frameworks, a huge number said this isn’t something they are doing at all. And even those who are tracking risks aren’t confident this is being done well.

One risk manager says: “[People risk] is identified in our strategic risk framework, so has visibility. However, [I’m] not sure how specifically [it is] measured in terms of talent gaps and ability to fill them.”

Another says they currently have “no measure of talent risks and currently no monitoring”, while a third says: “Badly. There is a lack of useful data on both expectations and performance.”

Baron emphasises the importance of embedding people risk within ERM frameworks. “Proper people risk identification and prioritisation at the enterprise level can only help focus on the appropriate risk mitigation and opportunity strategies.

Clear communication of the company’s culture and values, as well as the alignment of talent skills and work ethics, is crucial.

He says: “Are there areas that need to be changed to attract new skills and younger generations, such as management style, work/life balance or work environment? If talent retention is a confirmed issue or weakness, it needs to be properly articulated as a top priority risk, and appropriate mitigating actions need to be decided and implemented.”

IN PRACTICE: TENDING TO TALENT

Sandy Tay, director of group HR at National University Health System, one of three public healthcare clusters in Singapore, and PARIMA board member, shares how her organisation is tackling talent risks.

STRATEGIC WORKFORCE PLANNING

- Explore predictive analytics to forecast talent needs in critical areas.

- Align workforce strategies with business goals to ensure preparedness for future demands and supply

UPSKILLING AND RESKILLING PROGRAMS

- Implement continuous learning initiatives to develop existing talent by either upskilling or reskilling to bridge the gaps.

- Transform the workforce by redesigning roles, or identifying new or emerging roles through cross-training employees.

- This mitigates the gaps and streamlines processes.

STRATEGIC TALENT ACQUISITION

- Develop employer branding (such as ‘Employer of the Year’) to attract top talent.

- Expand recruitment pipelines through partnerships with universities, training centres, and scholarship to tap resource in early stage.

- Leverage global talent pools to find candidates with niche skills.

RETENTION AND ENGAGEMENT STRATEGIES

- Foster a culture of innovation and inclusion to retain talent.

- Conduct regular employee engagement surveys to address potential dissatisfaction early.

AUTOMATION AND TECHNOLOGY INTEGRATION

- Use technology to automate repetitive tasks, reducing the need for roles that are difficult to fill and increase efficiency.

- Invest in AI and data-driven tools to enhance productivity and innovation.

METHODS TO TRACK THE RISK

Those risk managers who are measuring and addressing talent gap risks point to turnover ratios, vacancies, appraisals, engagement surveys and risk assessments as key areas they pay attention to.

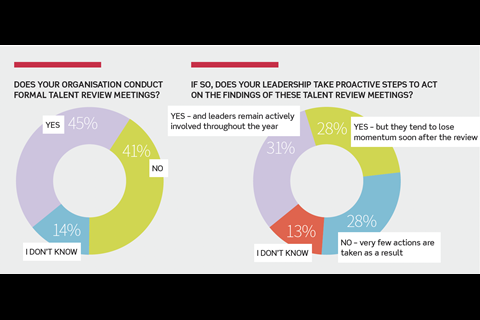

Another common approach in measuring peoplerelated risks is through review meetings. But our research shows that just 45% of businesses conduct formal talent reviews, while 14% of risk managers aren’t even sure if their organisation does this.

Among those businesses that do have processes in place, 28% say that very few actions are taken as a result, and a further 28% say that while leadership took proactive steps to act on the findings of talent review meetings, momentum was quickly lost.

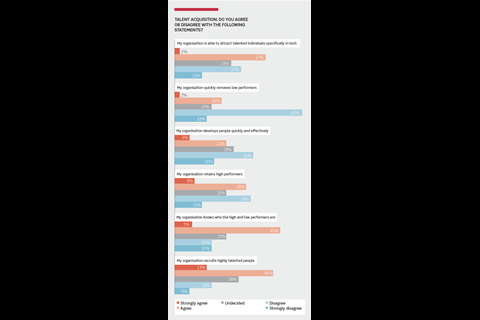

This was borne out when we asked about the state of talent acquisition. When asked if their organisation recruits highly talented people, 21% disagreed or strongly disagreed, 30% do not believe their company knows who the low and high performers are, 42% say their company can’t retain those high performers and 65% say their business is not able to quickly remove low performers.

In terms of skills and training, just 27% say that the business develops people quickly and effectively, and only 39% said that the organisation could attract the talent in technology that is required for business success.

RSA’s Jones comments: “It’s not just the attraction of talent, particularly among the younger generation, but also the ability for new entrants to build up their knowledge bank and experience.

“While we’ve benefited from some really motivated, good, qualified graduates, experience is earned over time, along with job-related knowledge, as it is passed from the more experienced to the less. And this takes time. Therefore, organisations need to think as much about the older generation as the younger to facilitate this knowledge exchange.”

In terms of technological changes, Jones believes that the greatest challenge is identifying and addressing the interconnected threats and how they change the risk landscape.

He says: “This demands a broadening of thinking from risk managers and breaking down of siloed thinking that isn’t always easy. This is along with a need to create time and space for risk professionals to upskill themselves on how these technologies are developing.”

HELPING YOUNG TALENT TO BLOOM

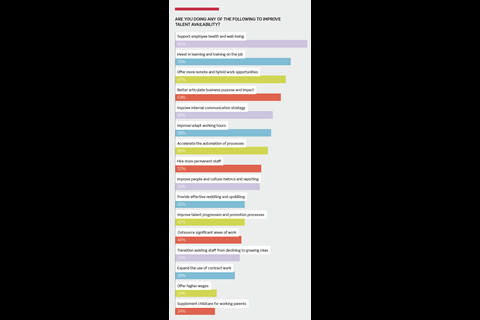

The research does provide some evidence that organisations were putting measures in place to attract talent, even if these weren’t factoring into risk measurement.

For instance, 80% of risk managers said their firm supported employee health and well-being, 70% said the company invests in learning and training on the job, and 67% are offering more hybrid and remote working opportunities.

Less popular measures included offering supplemental childcare for working parents (24%), offering higher wages (25%) and expanding the use of contract work (36%).

When we asked risk managers to evaluate the greatest barriers to attracting and retaining the talent that their organisations need, the results showed that current obstacles included competition from other industries (93%) and the range of benefits on offer (83%).

Economic conditions, lack of opportunities for growth and enhancement, and lack of appeal to younger generations were all barriers to 80% of companies.

Looking to the future, the top expected barriers were disruptive new and emerging technologies or other market forces (76%), managing shifts in employee expectations (63%), and heightened regulatory changes and scrutiny (59%).

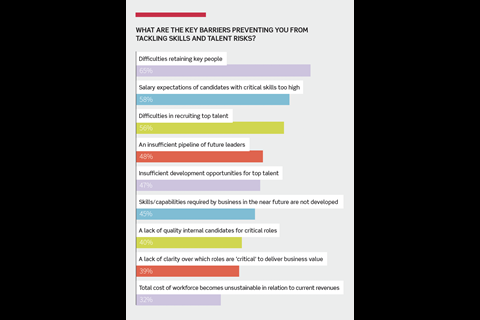

The key barriers to addressing skills and talent risks were difficulties in retaining key people (66%), heightened salary expectations of candidates with critical skills (58%) and difficulties in recruiting top talent (56%).

Sarah Mantle-Gray, director of total talent at RSA, comments: “Many younger employees, particularly Gen Z, are choosing employers based on their social consciousness and ethical values.

“We have seen in our Early Careers assessment centres over the past few years the amount of research that this wave of talent does into our socially responsible activities. They show a new level of curiosity and a will to drive and support further action in their communities. They want to be advocates and they want to make an impact and contribute to something that aligns with their values. We see this resonate in climate change, social impact justice and mental health areas.”

She adds that when it comes to attracting the talent of the future, what’s always worked historically isn’t necessarily going to work in the future. As such, businesses must evolve.

“For example, with the increase of technology and AI, one trend we notice is that employees are looking for a more personalised employee experience. We believe that a ‘one size fits all’ approach to things like benefits, development and flexible working will become obsolete.

“We apply a diversity lens across all of our talent, succession, performance and reward processes, which enables us to identify any disparities faced by underrepresented groups, and make data-driven decisions to target actions. We put a big emphasis on benchmarking metrics to review our interventions and actions.”

NURTURING THE BEST

Franck Baron shares his top strategies that risk managers can deploy to improve talent retention.

- Establish a strong partnership with the HR department to ensure that talent risks are identifi ed and managed effectively. This includes working together on employee benefits, risk financing, and creating a supportive work environment.

- Invest in training and development to help employees grow quickly and efficiently. This not only improves their skills but also boosts loyalty.

- Offer flexible working arrangements and promote a healthy work/life balance. This can help attract and retain the younger generations and those with specific lifestyle needs.

- Ensure that the compensation and benefi ts packages are competitive and aligned with industry standards. This can help in attracting and retaining top talent.

- Foster a positive, inclusive work culture that aligns with the company’s values. This includes promoting diversity, equity and inclusion initiatives.

- Develop a robust performance management system that recognises and rewards high performers while addressing issues with low performers. This helps in maintaining a motivated workforce.

- Utilise technology to streamline HR processes and improve employee engagement. This includes using HR analytics to gain insights into employee behaviour and preferences.

THE RISK MANAGER’S ROLE

The research paints a picture of risk management functions that are divorced from people and talent risks. This may be because these people-related threats are seen as the purview of HR, separated from enterprise risk management frameworks by organisational silos.

However, speaking to senior risk managers, there is some evidence this might be changing, at least within larger organisations.

For instance, Scott Feltham, head of insurance at Compass Group, has recently absorbed some aspects of employee benefits into his role. By integrating these responsibilities, he has been able to streamline processes and leverage relationships with existing insurance carriers to obtain better deals and coverage for employees.

He says: “When I joined Compass Group, I sensed there was an opportunity to consolidate employee benefits and bring things together to capitalise and leverage our position as a very large buyer of insurance.

“If we look at other corporates of a similar size, we are beginning to see a paradigm shift – heads of insurance or risk are starting to take some control over employee benefits, especially those underpinned by insurance, such as life, accident, dental and health.”

He adds that risk and insurance leaders have a lot to bring to the table, in terms of optimising spend and negotiating better terms with providers, not to mention considering how vehicles like captives and pooling can help better manage people risk and benefits provision.

However, he stresses that HR, risk and insurance must work closely together. “I’m finding we’re working in unison more than we used to. We’re breaking down silos. I think HR recognises the value that I can bring in terms of my experience on the insurance purchasing side, and I recognise the value they can bring in terms of people risk management. And actually, why wouldn’t we leverage that? Why wouldn’t work in unison to determine and generate the best possible outcomes?”

The StrategicRISK Tackling Talent Risk Survey, carried out in association with RSA, took place in November and October 2024. A total of 103 risk managers took part, from a broad range of industry sectors. Of these, 34% were based in Europe, 24% came from the UK, 12% from Asia Pacific, 11% from the Americas, 8% from Sub Sahara Africa, 3% from other areas and 2% from Middle East and North Africa. Risk managers were invited to take part in an anonymous online questionnaire comprised of quantitative and qualitative question areas.

No comments yet