More than 700 business leaders share their views on barriers to technology innovation adoption, and the scope of business disruption driven by emerging technologies

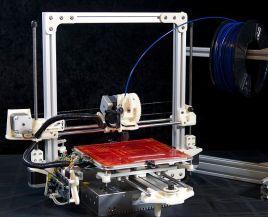

3D printing, Internet of Things (IoT), and biotech/ healthcare IT are among the top five disruptive technologies predicted to change the way we work and live over the next three years, according to the 2014 KPMG global technology innovation survey.

The trio of technologies were selected by more than twice as many respondents as in last year’s survey. Their dominance was noted together with the continuing impact of cloud and mobile and the steady rise of data and analytics, autotech, and artificial intelligence – all of which are expected to transform organisations.

KPMG surveyed 768 technology business leaders – 70% of which were c-suite executives - to identify disruptive technologies, barriers to tech innovation adoption, and the scope of business disruption driven by emerging technologies.

“There is so much room for technology to drive growth and enable change. Yet while businesses across the globe are excited about the prospects that new tech-driven ideas can offer their bottom line, a hint of nervousness remains. The sectors and the businesses that will enjoy greatest success, however, will be those prepared to take a chance on something new. That’s not to say they should gamble on the next ‘big thing’ – but they shouldn’t be afraid to try,” says Tudor Aw, KPMG’s UK head of technology.

The ‘Internet of Things’ as a revenue driver

The survey reveals that business leaders believe that so-called ‘intelligent shopping’ has the greatest potential to generate revenue because of the IoT (20%) as devices communicate with each other. They also suggest that home automation (14%), and surveillance/security and social interaction (both at 12%) will also act as revenue drivers in the next three years.

Digital currency

Digital currencies were also identified as one of the emerging technologies most likely to impact business between now and 2017. However, the extent to which they are likely to become a widespread method of payment varied enormously by geography. For example, respondents across Europe were twice as likely (32%) as their counterparts in America (15%) to suggest that digital currencies will disrupt banking and payments in the next three years. Even this figure was, however, dwarfed by respondents in China (70%).

Challenges to tech innovation

Yet it is not all good news for fans of technology. When asked which factors will limit or constrain innovation, 34% focused on restrictive regulatory policies, while 29% cited consumer fatigue. Just over one-quarter (27%) said that the ability to successfully demonstrate ROI was also a hindrance.

Survey respondents also suggested that the top barriers preventing them from commercialising technology innovation were security (27%), technology complexity (22%) and customer adoption (21%).

“Everything from the home computer to the smart-phone has shown that consumers are willing to embrace new technologies. After all, 15 years ago, no one would have thought that people would be as comfortable shopping on the move or banking over the air, as they are today. The businesses that are quick to realise that we are only at the start of a technological innovation revolution will be those that uncover the next ‘big thing’ – and they will be the ones standing it in what is becoming an increasingly crowded marketplace,” concludes Aw.

No comments yet