Most executive decisions are made with the company’s EBITDA in mind. So, aligning your key risk indicators to your EBITDA will ensure that the risk department stands out. But achieving this isn’t always easy. Adrian Clements, international enterprise risk manager, has this advice

In previous articles, I mentioned that each action within an industrial or financial organisation, will affect either severity, frequency or both to a certain extent. The priority of these actions will depend on the overall strategy of the company and the goals set by management. Whether a conscious decision is made, I’m not sure, but most decisions are focusing on severity. Ie increasing EBITDA.

This implies we need to know by how much will EBITDA change with each action completed? In order to be able to answer this question we need two things.

- The correct KPI to measure and

- The financial calculation that highlights the EBITDA impact this KPI will have on the results

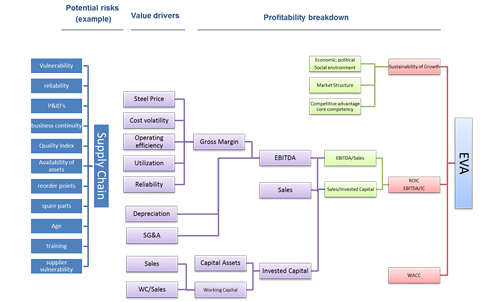

Typically, the KPI is either a purely operational one and is difficult to convert to monetary terms or is a financial one which the operations people can’t break down into the process steps that actually take place in normal production flow. The risk manager, therefore, needs to facilitate a process to create insight as it involves the strategic link between operations and finance. An example is the managerial bridge shown below created by the industrial controller.

The industrial controller is one of the most important, but underestimated, functions in a company today. This is the function that can show the value risk management brings to a company. But how many risk managers use this function? Very few unfortunately. Why is that? Possibly because we use the wrong KPI’s.

So what is the right KPI so that it can effectively be managed? We are lucky that we can use this same approach in two different ways to highlight the EBITDA impact of the actions being proposed. These two actions are again defining what risk management actually is. Namely risk and opportunity.

It is very easy to use KPI’s which have been around for many years and for which there are benchmarkable results in today’s world. This can be a big mistake.

Lets take MTBF (Mean Time Between Failures), a typical maintenance focused KPI. If I have old assets, targeting new products, and the maintenance budget has been cut to bear minimum then this is a great KPI. I can run the assets slower. It puts less stress on the asset, the failure rate is reduced. Target reached.

Imagine my boss asks me now to increase tonnage. By doing this I start to have quality issues. It means that each product needs to pass through the same machine twice so that I get the customer quality needed. I will choose operating rate as the KPI. The machine is operating 100% of the time. Target achieved.

When I conduct an analysis on the data, I see no great actions needed. But overall the assets are running slow and only producing say half of their actual name plate capacity. My costs are too high. Solution? New assets more capex. Same old story. Exactly what is shown in article 2 of this series.

By creating the driver tree of production, you can add KPI’s together to find the one that shows where value is being lost and create the action needed to improve. How to understand which KPI is the one adding value rather than easy to manage.

Finance people are very aware of driver trees as the typical financial parameters are based on the value trees.

What about operations? Processes are typically broken down into blocks where transformations take place but not necessarily into blocks where value is created. So from a risk management viewpoint, or from a stakeholder viewpoint, what actually do I want to highlight?

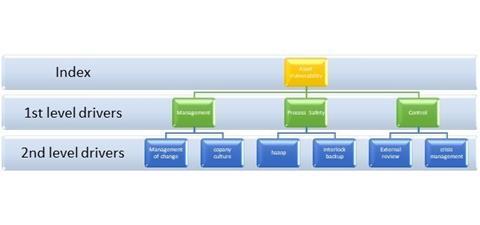

I want to show how vulnerable I am to not achieving the strategic goals. Ie addressing the EBITDA leakage question raised earlier. The three parameters that I can use to assess this, and to keep it simple and use techniques already used in industry, can be people, processes and the control I have in place.

Showing this in a practical example I can say that for the assets of an industrial company the level of vulnerability will depend on the management system in place, the level of process safety implementation and the level of control implemented. The management element is making the system work and focus on the company goals, the process safety is influencing the frequency of events creating leakage and the control is addressing the severity and resilience of the activities to shocks.

Each of these three sub elements of vulnerability can be further broken down into elements addressing specific areas of, for example, management. Ie ability to capture lessons learnt, maintenance programs, management of change, company culture, etc.

As we extend this approach to other areas and domains, we can start to see that the categories, if chosen well, begin to repeat. It is these synergies, or systemic issues, that will ultimately generate the value that has been missed in many processes used in the past. Through the use of this approach the actual cost benefit of certain actions can be correctly calculated. This means an action that is considered too expensive might become reasonable when you can consider holistically the impact. The cost benefit efficiency is enhanced.

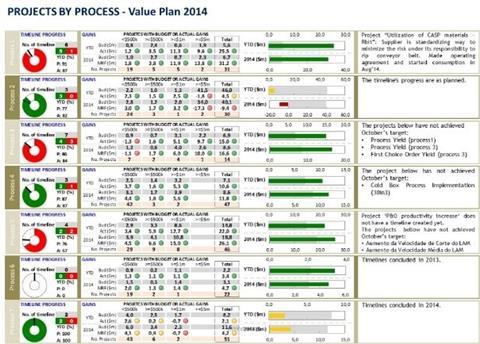

Attached are two management pyramids, one for maintenance the other for continuous improvement typically used in companies today. Through knowledge management and alignment of actions accounting can highlight the value each action will bring in its entirety to the EBITDA.

A large step forwards from the silo management approach using in many processes.

An example of such an action plan based on driver synergies is shown below.

When combined to form the managerial bridge we can identify the action priority needed to stabilise results. As its transparent its sustainable.

Which actions are changing systemic and starting the culture change to sustainable EBITDA growth?

- Of course know what risk management is?

- Where’s all our money going?

- Severity or frequency – which comes first?

- Barriers creating openness

- The playing field is not flat!

- What do you mean I’m the owner?

No comments yet