No return to contingent commissions StrategicRISK is told

In light of a New York regulatory decision to level the playing field and allow brokers to accept contingent commissions again, StrategicRISK asked the big three brokers where they stand on this thorny issue.

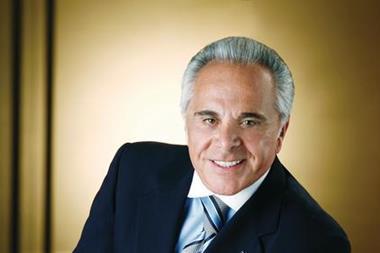

Chief executive Joe Plumeri told us that Willis has completely replaced contingents with upfront commissions in its retail brokerage operations, with the exception of HRH (Hilb Rogal & Hobbs), acquired in 2008, where they are still accepted to a small degree. Plumeri said HRH was 90% clean of contingents.

Plumeri called the practice “archaic” and he insisted that retail brokers should wipe them out because they represent a fundamental conflict of interest. He said the best way for it to do this—rather than waiting for a global ban to be enforced, which, he said, is logistically impractical—is for buyers to demand it from their brokers.

“I think the more people think about this and the more they can be educated through these kinds of dialogues that they’ll stop and think about it. And the best way to regulate contingents out of business is the buyer basically doing it. You have a buyer’s revolt. I hope that happens and then you really have a level playing field.,” said Plumeri.

David Prosperi, Aon's spokesman, said: “Aon stopped taking contingent commissions in 2004 and has no current plans to begin accepting them.”

Aon said transparency was the key so that “clients fully understand what they are paying for and the value they receive”.

“Neither Aon nor Marsh admitted in their written comments to us that they thought contingents represented a conflict of interest.

Marsh’s spokesperson added: “We are committed to transparency. Over the last few years we have learned a lot from listening to our clients and regulators. We know that clients want to understand how we are compensated. We are going to continue to provide to our clear disclosure to our clients and to provide them with the necessary information to help them make decision in the insurance-buying process.”

All of the big three brokers recalibrated their retail brokerage operations after the Spitzer inquiry to drive out contingents. This process took some years. Generally contingents were replaced with upfront commissions from the insurers. In some parts of their business brokers continue to receive commissions linked to the quality and quantity of the contracts which they place on behalf of insurers, but in these instances they claim no conflict because they are representing the insurer.

Neither Aon nor Marsh admitted in their written comments to us that they thought contingents represented a conflict of interest.

Marsh did say: “If our compensation creates the appearance of conflicts of interest, we will manage those conflicts by monitoring them, disclosing them to clients and satisfying all legal and regulatory requirements.”

All of the brokers welcomed the fact that the decision by New York’s insurance regulator would level the playing field so that all regulated brokers operate under the same rules.