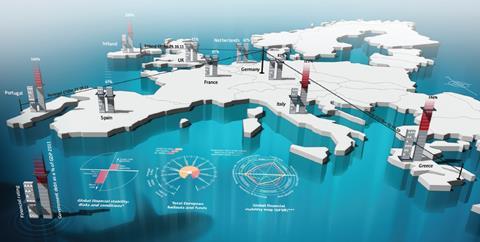

Europe’s sovereigns are in a fine mess, as this infographic from StrategicRISK shows. As the debt crisis worsens, Portugal and Ireland are struggling to regain their composure and Greece is in line for yet another bail-out. What will happen if the trouble spreads?

The escalating eurozone crisis could have a big impact on European insurers and, if it does, it could put upward pressure on premium rates.

Considerable uncertainty in the global economy, stock market volatility and talk of a double-dip recession has been a feature of the past year.

Macro economic risks have increased significantly in the past year while, in general, corporate risk appetites have slumped.

The failure to deal decisively with Greece has eroded confidence and made a default on its debts seem all the more likely.

In the rest of Europe, there are fears that the debt crisis that began with Greece, Portugal and Ireland could spark contagion to some of Europe’s bigger economies, in particular Italy and Spain.

As the graphic above shows macro economic risks have increased significantly in the past year while, in general, corporate risk appetites have slumped.

Partly this is the result of the dire state of Europes sovereigns. Debt to GDP ratios are over 100% in several key markets including Portugal, Ireland, Italy and Greece (the so called PIIG markets).

Meanwhile credit rating downgrades abound—you can also see the state of Europe’s sovereign credit ratings in the graphic above.

For the risk management community the macro-economy is a concern: it holds the more immediate prospect of premium rate increases in the insurance industry as a result of sovereign debt exposures that threaten businesses going forward.

This was one of the key messages ahead of the Ferma conference in early October.

No comments yet