A survey by Marsh reveals risk management has yet to be fully integrated into board-level decision-making

A survey by Marsh has revealed that risk management has yet to be fully integrated into the decision-making process at board level among top European businesses.

The survey, conducted among risk managers at the recent annual conference of the Association of Insurance and Risk Managers (AIRMIC) in Edinburgh, found that only 30% of respondents felt that risk management was always or consistently taken into consideration in the strategic decision-making process, while 22% felt that it never or rarely happened at all.

Asked how they measure the value of risk management, 35% said it was the impact on ‘cost of risk’, while 25% measured it in terms of reduced incidents or losses. Only 5% cited reductions in insurance premium while 14% said that they did not measure value.

On responding to their biggest risk management challenges, quantifying risk and demonstrating value were of greatest concern to three-quarters of the delegates; 37% found embedding risk management into their organisations a challenge.

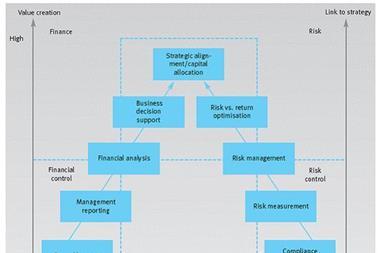

Commenting on the findings of the study, Eddie McLaughlin, Leader of Marsh’s Risk Advisory Group for Europe, the Middle East and Africa, said: “It is clear from our research that UK risk managers feel that risk management still has some way to go before achieving full recognition in the boardroom.

“However, organisations do recognise that managing risk is critical to their long-term success and competitive advantage. The challenge remains proving the shareholder value added through effective risk management. Progress has been made by linking risk management quality to capital allocation, and over time to a firm’s credit rating, but as an industry we are not there yet.”