In the area of captives the Isle of Man has faced stiff competition, could recent developments in local regulations improve things for the island?

Ever since the 1980s the Isle of Man (IOM)—located at the geographical center of the British Isles—has attracted its fair share of financial firms looking for an offshore domicile.

The island is currently home to 160 (non-life) authorised insurers, with gross written premium of around £1bn and approximately £5bn assets under management.

Traditionally businesses have been drawn by the island's low tax economy, its proximity to key markets and visibility within the financial sector.

IOM was recently voted 21st, ahead of offshore competitors Channel Islands, Cayman Islands and Hamilton (Bermuda), in the City of London’s second global financial centres index.

Nevertheless, in the area of captive risk financing IOM has faced stiff competition from around 70 other potential domiciles, many of whom have moved more quickly in developing commercially important regulatory frameworks.

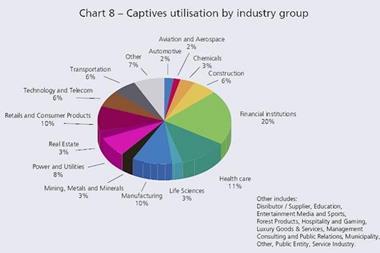

In a February 2007 survey, Aon found that Bermuda—with 26.1% (277) of the total number of captives—ranked first as the domicile of choice for its list of current global 1500 companies. IOM came sixth with 3.9% (41). And Guernsey, which like IOM is outside of EU jurisdiction, came within the top five.

While some agree that consolidation has led to a reduction in the number of captives, the Aon research bodes well for IOM finding that captive growth overall is not slowing and has not yet reached saturation point: It said, more than half (53%) of global 1500 companies did not yet have a captive at parent level.

“A key focus going forward is to ensure that we have the right strategy and structures in place to continue to take our place at the forefront of the international finance arena.

The new director and head of IOM Finance, John Spellman

Prompted by the increasing competition and opportunities, officials from the IOM’s UK independent regulator have launched a captive sector review with a view to grow and develop the market, which has typically been dominated by British based parent companies.

Derek Patience, chairman of the Manx Insurance Managers Association (MIMA) on IOM, commented: “The Report…emphasises that in order for us to move ahead of our competitors, we need to renew our focus and raise our profile.”

The island's financial regulators have stressed the need for domicile laws to be commercial in their outlook. The new director and head of IOM Finance, John Spellman, commented: “A key focus going forward is to ensure that we have the right strategy and structures in place to continue to take our place at the forefront of the international finance arena.”

And amendments to the Island’s Insurance Act have provided for the relatively easy re-domicile of captives from other jurisdictions. Important recent developments include the Protected Cell Companies Act of 2004, and the Insurance Company (Amalgamation) Act of 2006 which makes it easier for two captives to join.

In a move designed to reinforce its competitiveness, the IOM is considering the introduction of Incorporated Cell Companies—which would give large groups and trans-nationals greater legal certainty over the separation of assets—by early 2008.

David A. Vick, chief executive of the IOM Insurance and Pensions Authority, commented: “I think companies want to feel they are in the jurisdiction that has the full range of options.”

No comments yet