The downfall of AIG threw AON’s team into crisis management mode. But the broker remains confident that the turmoil will reveal new opportunities

Peter Harmer was on a plane to Chicago when he heard AIG was in trouble. The moment the flight landed, he faced a dilemma: should he jump on the first plane back to the UK, as clients jammed the Aon switchboard? Or stay at the group’s Chicago headquarters to deal with the crisis direct?

‘It was a case of being damned if you do and damned if you don’t,’ he says, a bit more comfortable now in his City office on Devonshire Row. ‘I didn’t want to get caught on a plane, so it was better to stay in the US and get a first-hand understanding of how we intended to deal with the crisis.’

Two months after the crisis broke, Harmer has turned his attention back to his own business. A no-nonsense Aussie who nevertheless slips into corporate speak if you let your guard down, he met StrategicRISK following one of the biggest acquisitions in the sector’s history – the $1.75bn bagging of Benfield – and outlined his plans for the UK’s number one broker.

There are big, if rather hazy, changes afoot – of which more later. But he can’t ignore the financial crisis, so neatly encapsulated by that agonising plane ride back in the Autumn. Within hours of landing, he had got the troops into action. ‘Situation rooms’ were set up on both sides of the Atlantic and dozens of extra phone lines installed. The Aon team hit the phones in a desperate bid to reassure clients and offer them alternative insurers if needed; there were plenty of offers.

It had to get its own house in order, too. Harmer says the group had more than $8bn (£5.2bn) of business exposed to AIG. There was no contingency plan for an event this big – no one expected it to happen. ‘It was clear that AIG took everyone by surprise,’ he says. ‘But clients in the UK were largely reassured by the US Fed package; very few switched away from AIG. We’ve viewed the crisis at AIG as an opportunity. But it certainly focused everybody.”

The AIG crisis could not have come at a worse time for the chief executive, an Aon lifer. It erupted just as he was trying to step back from the day-to-day business, to plan some big changes. He took the helm at Aon UK in January 2007 after a career with the group in Australia, at difficult times for Aon and global brokers generally. The dressing down from the US regulator post-Spitzer in 2005 was still ringing in their ears, and with contingent commissions out of the window, Aon had to overhaul its business model.

And then came that Benfield deal, announced in August. It made headlines across the globe, but with rumours of discontented staff and questions about the price tag, Harmer does not seem comfortable chatting about it. Aon has already confessed it needs to slash £65m off the Benfield cost base. But Harmer is sanguine, insisting £65m is a realistic target.

Aon paid $1.75bn for Benfield after fighting off fierce competition from Marsh, in the weeks before the depth of the financial slowdown became apparent. Its acquisition gives Aon control of an estimated 45% of revenues in the reinsurance broking market.

Now the economic crisis is in full bloom, does he think Aon paid too high a price for Benfield? ‘Too much?’ asks Harmer, surprised antipodean tones in full evidence. ‘It’s a very good buy at $1.75bn. The market thinks it’s a very good buy. Look at its clients and its share price. It has been very resilient.’

It is said with a smile, but it does not answer the question – Harmer is good at that. So, put another way, if Benfield were to be acquired at today’s prices, would the same price have been paid? He pauses before replying (and the Aussie accent steps up): ‘My dad used to say to me, if your aunty was a man, she’d be your uncle.’ His deadpan face crumples into spontaneous laughter – a signal to back off, perhaps.

Harmer is savvy as well as gregarious. He has developed a reputation for resolving conflicts at Aon and as chairman of the Lloyd’s Market Reform Group – although he is probably too busy right now to give his full attention to the group. His days are filled with the mission to reform Aon and he is currently reviewing the business’s structure.

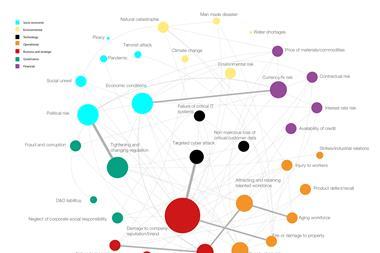

The plan is to reposition the way Aon manages its clients. ‘Many companies are realising the systemic nature of some of their risk exposures and realise the need for getting more analytical services,’ he says.

‘Brokers have pretty much become, over time, glorified product resellers. The advice brokers typically gave clients has been shaped by the limitations or the features of the products. That may explain why there has not been any real innovation in the way that we look at risk.’

Reading between the lines, Aon is planning to market itself better as an advisor to its corporate clients, and invest in risk management and strategic advice rather than simply flogging insurance. This will include a clear range of segmented services, which will take about 12 months to roll out.

Harmer predicts a much tougher regulatory environment and expects a high level of scrutiny of capital adequacy, especially for larger firms. But he maintains that Aon has the appetite to make more acquisitions if it can find businesses that provide services their clients need.

Harmer says, bafflingly, that the new Aon business model has been built around the concept of ‘advice plus transaction equals value for the customer, and not the other way around.’ You kind of know what he means, but just hope that the rest of Aon will too.

No comments yet