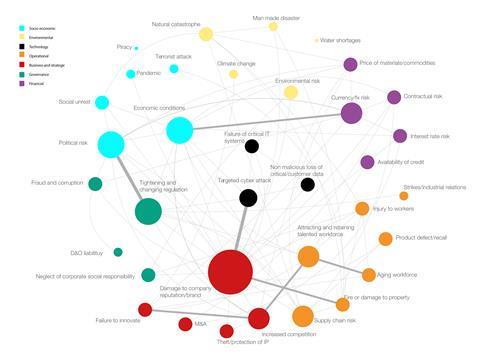

As risks become ever more connected, businesses are struggling to transfer the critical threats to their businesses. Insurers must shape up, or face companies turning to captives to manage key threats

The chair of a powerful group of risk mangers has said the insurance sector must move away from traditionally siloed views of risks as the world becomes ever more complex and risks interconnected.

David Broughton, head of insurance risk at Centrica, chairs the working group on connected risks, created and hosted by risk analytics company Russell Group.

The group has 30 members and has grown rapidly which Broughton says is testament to the growing recognition of the need for a more joined up view of corporate risks, which are increasing in complexity.

“It is interesting to see how siloed the industry has been when it comes to the approach to risk,” he says. “The biggest issue our businesses face is risk which are now becoming layered on other risks.

“We cannot have a siloed view of the world.”

“It is something that has been recognised increasingly by risk managers and corporate leaders and the world group was formed to look at ways in which we can better identify how these risks interact”, Broughton adds.

He says that a key concern among the group is the widening insurance gap, and the number of critcal threats that cannot be transferred to insurers.

He explains: “We now have 30 members on the group from large companies who face these ever more connected risks. The concern we have is that many of these risks are in areas which are at present not insured.

“We are looking to create a consensus in the direction of travel and to define what these connections are.”

Broughton added that the inability of companies to access insurance capacity is a topic which remains high on the group’s agenda. While the ability to define the risks and identify the areas where action is needed is increasing, finding and using insurance is not always the easiest solution.

“At present geopolitical risks, the digitalisation of businesses and processes, the rise of artificial intelligence, the supply chain, the globalisation of industry, regulatory risk and reputational risk are significant issues,” he explains. “The point is that when you consider these significant and ongoing risks, they are all interconnected in many ways.”

He adds: “We see these risks tending to be driven by the business model rather than the business sector… Some of our members with large asset portfolios have different approaches to the issue of AI compares to some of the group’s members which have large retail portfolios for instance.”

On the lack or the ability to use insurance to mitigate the risks, Broughton said the market may well be approaching a tipping point at which insurers will need to react.

“For insurers, they need to recognise that if they do not remain relevant to big businesses, we will find another way,” Broughton says.

“For us, 20 percent of our risks are actually insured with 80 percent deemed to be uninsurable at present. The industry needs to change, it needs to adapt to the changing risks its clients face and to do so it will need to breakdown the underwriting silos which often driven by risk classes.”

He continues : “How are businesses managing these risks? The reality is that for some risks they will never be insurable. We need our businesses to be successful and our customers want our businesses to be successful. We are seeing the rising need to look at the world though a different lens.”

Broughton adds that AI and technology was a case in point where the insurance sector needed to work with its clients and risk managers to create solutuions.

He said: ”Clearly, we cannot produce ten years of claim data so we need to understand how does the risk play out with insurers. Insurers say they want to play a part in our risk management strategies but add it is difficult to assess the risks without the claims data. They have to factor in that we don’t invest without a risk assessment.

“The question we need to answer is will insurers use our risk assessments, which were undertaken to examine the risks of that investment in order to underwrite the cover we are seeking. If the market does not react then it is likely we will need to turn to our captives.”

“If we are faced with having to assume the risks and it turns out that our assessments are correct and it is a risk we can deal with, insurers have to understand the risks will no return to the market. “Insurers put up so many caveats. It is a more complex world but it does not challenge the underwriters. If you want growth you have to do things differently.”

On the aims of the group for the year ahead Broughton said no hard targets have been set.

He concluded: “We know what we are after is a big ask so we are not setting targets,” he adds. “What we want to do is work with insurers to create more capacity in certain areas.

“As a group we are asking for more support for outcome-based coverage. We want to see products which articulate the outcome rather than the trigger. Our second aim is to create a collective voice and framework for communications which will enable better understanding and engagement with insurers.

No comments yet