Coca-Cola has been given a green light to reinsure benefit risks through its captive; the US Affordable Care Act is prompting smaller employers to self-insure healthcare benefits. Is this a turning point for employee benefit captives?

Coca-Cola was given approval by the US Department of Labor at the end of March to open up its captive insurer to underwrite additional benefit risks. The drinks giant’s Atlanta-based captive insurance company, Red Re, will now be able to deal with life insurance and accidental death insurance.

This is something of a landmark case. The captive owner is the first to be granted authorisation since the Department of Labor decided to review criteria that employers must satisfy to be granted fast-track approval of captive benefit funding arrangements.

“It is the first one in about six months in the US that has got that exemption,” says Charles Winter, chief operating officer and head of risk finance for Aon Global Risk Consulting. “It shows that the market is active again.”

“There are certainly differences in the markets,” Winter adds. “In the US, the noise is certainly around medical stop-loss [a policy that takes effect after a certain amount has been paid in claims], as the costs there continue to increase.

“We don’t see so much outside the US. We’ve got a number of enquiries in various stages but it isn’t a runaway market and it’s not something that everybody is doing.”

The employee benefit captives trend is most developed in the US and it is growing at a slow but steady pace under the Affordable Care Act (ACA). A small but increasing number of midsized companies are discovering that, by joining forces with other like-minded employers, they can achieve the critical mass to benefit from self-funded healthcare plans.

To date, there have been a small number of pioneers for employee benefit captives in the UK and Europe, and although it has yet been done on a strategic basis, activity is picking up.

“At the European Captive Forum 2012 conference in Luxembourg last November, and at Captive Live UK in February, captive owners were speaking about their experiences with employee benefits,” says John Stivala, general manager of JLT Insurance Management in Malta.

“Whereas before this was just a subject to be discussed – something on the wish list or something to consider – we are now seeing actual companies that have gone through the process of including employee benefits and a lot of them are saying it is a success story. I can recall Vodafone speaking about that at the UK conference.”

Why self-insure?

There are various advantages associated with using a captive to reinsure certain benefit programmes – such as life, healthcare and disability. These include advantages typically associated with self-insurance, such as reduced insurance costs and improved underwriting flexibility. In addition, the use of a captive for third-party business can lead to tax advantages in the US.

Following the financial crisis, the issue of getting more use out of a captive insurer has remained high on the agenda.

“Everyone is looking at the state of the market and what’s going to happen in terms of it becoming more difficult. Their captive is there as a sort of shock absorber – and they can really use it as a tool,” says Ken MacDonald, head of corporate risks at Miller Insurance Services. “It’s a mature risk management approach – as you’re getting more understanding of your risks and greater control, you can get more confident in taking bigger retentions and putting in different types of business.”

The employee benefits sector represents an attractive risk for many captives. The risk profile of employee benefits is characterised by high and stable frequency with low average severity. For most corporations, the majority of this risk – with the exception of extreme tail risk – can be retained. For parent companies with existing captives, there are capital efficiencies and diversification benefits to be had by opening up an existing captive to a new class of business.

“If they are using their captive for some of the traditional property casualty types of coverages, they may have several classes with very long tails and low incidence. Some of the stop-losses – which are very short tail and may have a more predictable base – add stability to that mix,” says Milliman principal and consulting actuary Bill Thompson. “So there’s a risk diversification.

“If you look at total required surplus for a captive putting in these lines, then it would probably be less than the sum of its parts from a risk management standpoint.”

Rising healthcare costs The rising cost of healthcare around the world is becoming a growing burden for the private sector, as governments look to transfer some of the cost responsibility to employers. Healthcare costs as a percentage of GDP are in the double digits in OECD countries. They are highest in the US, where healthcare accounts for nearly 18% of total GDP. And annual healthcare spending in the US has been projected to reach $4 trillion by 2015.

While the option to put employee benefits through a captive insurance company is not a new concept, more and more multinational organisations are doing this as the cost of healthcare becomes a concern. Large global organisations – Alcoa, Alcon, AstraZeneca, Coca-Cola, Deutsche Post DHL, GSK, HJ Heinz, Microsoft, Sun Microsystems and Wells Fargo – have all reinsured their group benefit programmes through US-based captives.

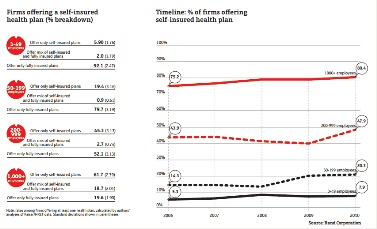

Almost six in 10 American private and public sector workers covered by employer-provided healthcare in 2010 were covered under a self-insured plan – up from about four in 10 in 1999, according to a survey by the Kaiser Family Foundation. Self-insurance coverage increased with employer size. In 2010, 16% of covered workers at small employers had self-insurance, compared with 93% of covered workers at very large employers (see chart).

However, taxes under the ACA have provided an incentive for both small and medium-sized employers to consider group captives for medical stop-loss covers.

“Under the ACA, one of the fees is a health insurance tax that applies to insurance companies, so it would not apply to the self-insured business,” says Thompson.

Captives could help better manage stop-loss premiums for smaller employers when, in 2014, the ACA changes insurance for smaller groups.

Thompson says: “A structure I typically see is a bunch of employers that are smaller in size, with anything from 50 to several hundred employees – they might even be fully insured today – going to a self-insured arrangement. They use the captive as a pooling mechanism for taking on the medical stop-loss coverage for a certain layer of coverage, before the captive then goes and purchases coverage on behalf of everybody for the excess over that.

“By purchasing through a pooling mechanism, you’re purchasing your first layer of stoploss on a net premium basis rather than a gross premium basis,” he says.

“And to purchase the stop-loss coverage in excess of what the captive’s layer is, it’s a group purchasing for all the participants of the captive together – which is often on better terms than you’d be able to do on your own.”

One of the biggest difficulties in getting such a scheme off the ground is coordinating a group of different employers – some of whom may be completely unfamiliar with the concept of self-insurance. While feasibility studies may count on more than 20 different employers being involved at the start, that is quickly whittled down as companies drop out.

As Thompson points out: “People are getting cold feet. It’s the fear of the unknown – they don’t know what they’re getting into.”

No comments yet