Cyber / Technology Risks

The interpreter: How Tyn Van Amelsfoort translates security data into board-ready decisions

The stakes are high as AtkinsRéalis’ Tyn Van Amelsfoort navigates global security in a world of escalating threats. Luckily, he is fluent in translating complex risk data into the decisionmakers’ language, ensuring strategies can meet every new crisis.

APAC’s risk landscape is shifting fast: why resilience is now a strategic differentiator

Asia Pacific’s high-growth markets are facing rising geopolitical tensions, climate impacts, supply chain disruption and escalating cyber threats. Aon’s 2025 Global Risk Management Survey shows that organisations across the region are already feeling the strain, and many are rethinking resilience as a driver of competitive advantage.

Case study: How a risk control failure triggered a $3m loss in just six weeks

A routine cash-handling function turned into a multimillion-dollar loss when a misconfigured ATM enabled six weeks of fraudulent withdrawals. The case exposes deeper weaknesses in governance, data flows and assurance that allowed the incident to escalate unchecked.

Sector spotlight: why universities must rethink risk in an era of disruption

Once defined by tradition, universities are now facing degrees of change that are forcing a fundamental rethink of how they fund themselves, how they manage student interests and their approaches to handling evolving technological threats.

The deep thinker: How Martin Leo blends academic rigour and risk insight to strengthen resilience at NUS

Martin Leo has done his homework. At the National University of Singapore, he always comes prepared to engage with faculty at their level, then turns intellectual insights into practical risk strategies.

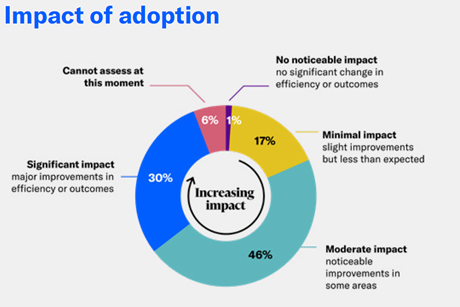

AI surge reshapes risk management and compliance

How is artificial intelligence improving risk management and compliance, who’s using it, and how fast is it being deployed? Ted Datta, head of the financial crime and compliance practice for Europe and Africa at Moody’s, reveals the findings of a global survey

Inside the hidden vulnerabilities weakening global data centre resilience

Data centres are at the heart of the digital economy, but rapid growth, energy constraints and evolving risks are testing their resilience. At an SR:500 event in partnership with FM, experts discussed the challenges facing the sector and how risk managers are responding.

SR 500: Cyber resilience takes centre stage

Previously a back-office function, resilience in the digital space is now in the spotlight. At an SR:500 roundtable in asssociation with Marsh, risk leaders explored how AI, regulation and culture are highlighting new strategies and demanding board-level attention.

DORA: The buck now stops at the top

In a new regulatory era heralded by DORA, accountability is on a whole new level. If you are a decision-maker, you could be held responsible for compliance failures far down your vendor chain. Companies must be insurance ready, warns BHSI’s Koen Cambré and Adrienne Sitbon.

Cyber response readiness: Why risk managers must lead from the front

Recent cyberattacks targeting prominent UK retailers have exposed the far-reaching consequences of digital disruption. Helen Nuttall, UK head of cyber incident management at Marsh, explains how risk managers can enhance organisational preparedness, facilitate cross-functional coordination, and refine crisis response strategies.

From silos to strategy: how boards are rethinking risk

Webinar: With boards more engaged, our next mission is clear: offer a wide-angle lens on how risks interact, and why risk management and opportunity can co-exist. Our panellists share candid insights on how to turn silos into the strategies a board wants to see.

In partnership with

Why risk managers are turning to parametrics to solve operational challenges

As nat cats grow more severe, insurance gaps are widening - but parametric solutions might hold the key to resilience, says Dianna Nelson, a senior structurer at Swiss Re Corporate Solutions