Ransomware

Hackers using stolen insurance documents to tailor ransomware demands

Cyber criminals are using stolen insurance documents to extort the maximum ransom from their victims, with one such group declaring, ‘we are very well informed and precise in our operations, so we know that Wootton have cyber insurance that reaches £500k’

Ransomware ban may backfire, experts warn

Industry experts warn government restrictions could displace attacks from public services to private companies, increasing pressure on boards to strengthen cyber resilience.

Case study: SK Telecom’s cyber breach shows why silence can be deadly in a crisis

Backlash from SK Telecom’s initially mute response to “the worst hacking case in the history of the telecom industry” highlights how critical transparency is after a data breach. Swift action is not enough.

Spotlight on: evolving deepfake risks and how to battle them

The technology is out there to impersonate your top execs, initiate false transactions, break into systems and even appear to engage in reputation-destroying behaviour. Deepfakes are now reality, but how do you equip your business to protect itself against such an insidious threat?

FERMA: the industry needs better collaboration to manage cyber threats

European risk and insurance industry calls for greater collaboration on cyber risk, and highlights the need for coordination between all stakeholders on solutions for evolving cyber risks

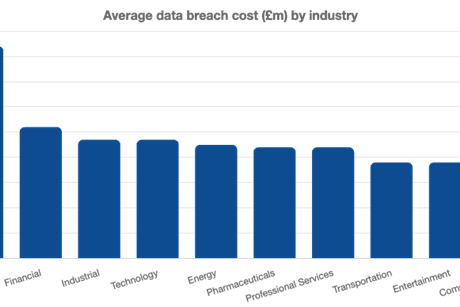

How can financial organisations use strategic benchmarking to navigate heightened risk landscapes?

Steve Bishop, research and information director at ORX, says firms must embed operational and non-financial risk into core strategy and use industry data to stay ahead of emerging threats.

Inside the hidden vulnerabilities weakening global data centre resilience

Data centres are at the heart of the digital economy, but rapid growth, energy constraints and evolving risks are testing their resilience. At an SR:500 event in partnership with FM, experts discussed the challenges facing the sector and how risk managers are responding.

SR 500: Cyber resilience takes centre stage

Previously a back-office function, resilience in the digital space is now in the spotlight. At an SR:500 roundtable in asssociation with Marsh, risk leaders explored how AI, regulation and culture are highlighting new strategies and demanding board-level attention.

DORA: The buck now stops at the top

In a new regulatory era heralded by DORA, accountability is on a whole new level. If you are a decision-maker, you could be held responsible for compliance failures far down your vendor chain. Companies must be insurance ready, warns BHSI’s Koen Cambré and Adrienne Sitbon.

Cyber response readiness: Why risk managers must lead from the front

Recent cyberattacks targeting prominent UK retailers have exposed the far-reaching consequences of digital disruption. Helen Nuttall, UK head of cyber incident management at Marsh, explains how risk managers can enhance organisational preparedness, facilitate cross-functional coordination, and refine crisis response strategies.

Webinar: Harnessing technology & AI for smarter risk identification

Watch our elevating risk intelligence webinar, in association with Origami

In partnership with

Why risk managers are turning to parametrics to solve operational challenges

As nat cats grow more severe, insurance gaps are widening - but parametric solutions might hold the key to resilience, says Dianna Nelson, a senior structurer at Swiss Re Corporate Solutions