Tech Innovation

Risk briefing: How AI agents can revolutionise risk

AI agents can transform risk management and compliance by automating complex tasks and enhancing decision-making efficiency.

Regulation Watch: US insurance regulators move from AI guidance to mandates

The RIMS Public Policy Committee outlines AI’s impact on insurance regulation, as US oversight shifts rapidly from voluntary standards to something more binding.

How to use digital tools and AI to improve risk management

Practical steps for risk managers to streamline processes, enhance decision-making, and improve collaboration with AI and automation

Heathrow’s fire was a wake-up call – here’s what risk managers must learn

The March 2025 substation fire that grounded Heathrow Airport for more than 16 hours disrupted over 270,000 passenger journeys and exposed systemic weaknesses across the UK’s critical infrastructure. StrategicRISK speaks to seven senior experts to explore what went wrong – and how to prepare for what’s next.

The strategist: FERMA’s new president has a gameplan to elevate the influence of risk

As Charlotte Hedemark takes up her dream role as FERMA president, she tells StrategicRISK editor Sara Benwell that helping risk managers to professionalise and elevate their strategic influence are key goals.

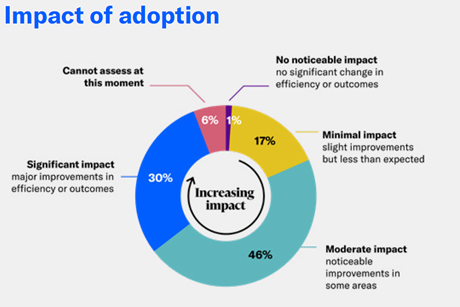

AI surge reshapes risk management and compliance

How is artificial intelligence improving risk management and compliance, who’s using it, and how fast is it being deployed? Ted Datta, head of the financial crime and compliance practice for Europe and Africa at Moody’s, reveals the findings of a global survey

Inside the hidden vulnerabilities weakening global data centre resilience

Data centres are at the heart of the digital economy, but rapid growth, energy constraints and evolving risks are testing their resilience. At an SR:500 event in partnership with FM, experts discussed the challenges facing the sector and how risk managers are responding.

SR 500: Cyber resilience takes centre stage

Previously a back-office function, resilience in the digital space is now in the spotlight. At an SR:500 roundtable in asssociation with Marsh, risk leaders explored how AI, regulation and culture are highlighting new strategies and demanding board-level attention.

DORA: The buck now stops at the top

In a new regulatory era heralded by DORA, accountability is on a whole new level. If you are a decision-maker, you could be held responsible for compliance failures far down your vendor chain. Companies must be insurance ready, warns BHSI’s Koen Cambré and Adrienne Sitbon.

Cyber response readiness: Why risk managers must lead from the front

Recent cyberattacks targeting prominent UK retailers have exposed the far-reaching consequences of digital disruption. Helen Nuttall, UK head of cyber incident management at Marsh, explains how risk managers can enhance organisational preparedness, facilitate cross-functional coordination, and refine crisis response strategies.

From silos to strategy: how boards are rethinking risk

Webinar: With boards more engaged, our next mission is clear: offer a wide-angle lens on how risks interact, and why risk management and opportunity can co-exist. Our panellists share candid insights on how to turn silos into the strategies a board wants to see.

In partnership with

Why risk managers are turning to parametrics to solve operational challenges

As nat cats grow more severe, insurance gaps are widening - but parametric solutions might hold the key to resilience, says Dianna Nelson, a senior structurer at Swiss Re Corporate Solutions