The UK saw its foreign investment halve while investment in the developing world surged by 43% in 2008

Foreign direct investment (FDI) flows both into and out of the developed economies slumped significantly last year, according to recently released statistics.

The figures suggest that the financial crisis and economic downturn have had a significantly negative effect on the role of the developed world in the global investment landscape.

The United Nations Conference on Trade and Development released its World Investment Report in Geneva this week (September 17).

“Developed countries as a group, however, retained their position as the largest net outward investors.

The report showed that in 2008 FDI inflows to developed countries as a whole declined by 29% to reach US$962bn, and they slid even more rapidly in the first quarter of 2009.

Meanwhile, a larger share of the money that was invested overseas last year went to the developing world. While globally FDI inflows are expected to fall from $1.7 trillion in 2008 to 1.2 trillion in 2009, the amount of this investment going to developing economies surged by 43% in 2008. In Africa, inflows rose to a record level, with the fastest increase in West Africa (a 63% rise over 2007).

Overall, FDI to the European Union (EU) was shown to be down 40% from its level in 2007. This was largely due to sharp declines in inflows to the United Kingdom (which saw its foreign investment halve), France, the Netherlands, and Belgium.

“Overall, FDI to the European Union (EU) was shown to be down 40% from its level in 2007.

FDI outflows from developed countries were also down by 17% over 2007, at $1.5 trillion in 2008. Flows from the EU fell by 30%, reaching $837bn, mainly due to significantly lower FDI from the United Kingdom. Overseas investments from the United States, which was the largest outward investor in 2008, declined by 18% to $312bn.

Developed countries as a group, however, retained their position as the largest net outward investors.

The United States, along with China, India, Brazil and Russia (the so-called BRIC countries) are likely to lead the future FDI recovery, read the report.

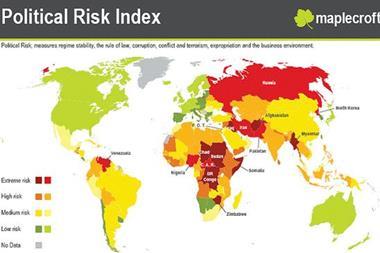

In light of these declining numbers some developed countries have adopted or amended rules concerning the review of foreign investment on national security grounds, while others have adopted measures aimed at further liberalisation of their investment regimes, or have changed tax policies and other incentives to promote foreign investment.

No comments yet