Study by Willis Towers Watson highlights wide variance in insurers’ performance

UK-regulated insurers operating in similar classes of business have turned in “markedly different” performances over the past five years, a study by Towers Watson has found.

The consulting and broking group found in an analysis of companies PRA returns that some companies have been far more effective than rivals in tackling soft rates and low interest rates, both of which have been a drag on insurers’ performance in recent years.

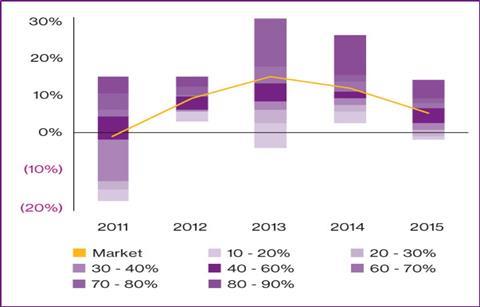

The study found that on aggregate, the UK non-life industry has performed relatively well in the tough market conditions compared with other industry sectors. Insurers reported an average return on equity (ROE) of 8% over the past five years.

But it also found a “marked variation” in performance between individual insurers. This was particularly noticeable in 2011 and 2013. But even in 2015, where the variance was smaller, there was a 15 percentage point difference between the ROE of the best and worst performing insurer that year.

Willis Towers Watson director Charlie Kefford said: “The aim was to investigate how companies performed against their peers during a period where below average natural catastrophe occurrences and strong competition have led to softening prices in a number of segments, and whilst interest rates have remained at historic lows.

“The significant performance spread among direct competitors in the UK non-life insurance market over the last five years demonstrates that companies have the ability to break free from the chains of external factors to improve stakeholder returns.”

Willis Towers Watson said that trimming business portfolios had become an “increasingly viable” option for differentiating returns, as it enables companies to direct resources to markets with better growth opportunities, potentially growing profits and freeing up capital.

No comments yet